June 1 is the start of hurricane season. It’s also a deadline for Florida property insurance companies to get their reinsurance in place.

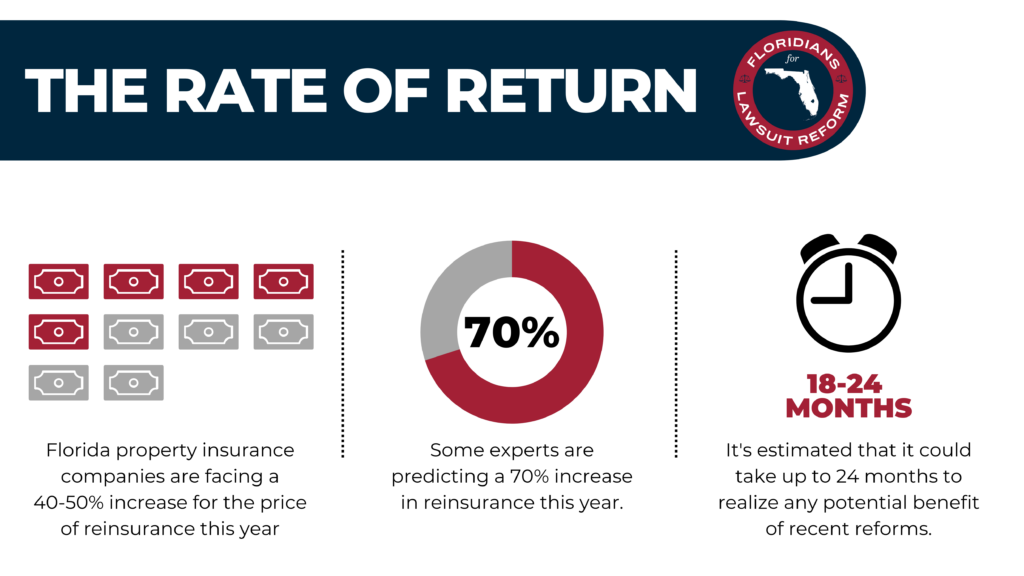

What’s happening: Insurance companies buy their own insurance — reinsurance — to spread out risk and cover claims. Experts are expecting the price of it in Florida to jump 40 – 50% — or even 70%.

- Of the money insurance companies rake in from premiums, they can wind up spending more than half of that on reinsurance, David Paul, principal of ALIRT Insurance Research, tells Axios.

Why it matters: Increased costs get passed on to consumers, and our state is in the midst of an insurance crisis.

- Companies have gone insolvent and rates have skyrocketed.

- A recent ALIRT report shows problems have been brewing since Hurricane Andrew in 1992. Reinsurers finally “cried uncle” this year, hiking prices or considering just leaving the state.

Context: Inflation, fraud, litigation, and Hurricane Ian — “the second costliest insured loss ever on record globally” according to a report by the American Property Casualty Insurance Association — all contributed to reinsurers backing away.

Yes, but: The state legislature passed reforms to reduce lawsuits against and costs for insurance companies, which should help lower rates.

- Critics have characterized these reforms as a giveaway to insurance companies.

What they’re saying: Bruce Lucas, founder and CEO of Tampa-based Slide Insurance, tells Axios reinsurance has a domino effect on the economy.

- Insurance companies need reinsurance to be rated “A.” Most people with mortgages are required by lenders to buy insurance from only A-rated firms.

- Without the reforms, “there would be a cataclysmic event taking place here in two weeks,” Lucas says. Some insurance and reinsurance companies would likely have stopped doing business in the state.

Between the lines: Seeing the opportunity to charge higher prices, Berkshire Hathaway decided to offer more reinsurance this year, Barron’s reports.

- The firm could lose as much as $15 billion if a hurricane hits Florida. But if not, “we’ll make several billion dollars as profit,” said Ajit Jain, Berkshire’s head of insurance operations.

What’s next: Even if reinsurance remains expensive, in about 18 months the reforms will kick in and lawsuits will die down, Lucas predicts.

- That will save insurance companies money and consumer rates could then drop substantially.

💭 Deirdra’s thought bubble: I insured a townhouse last year for $2,877 and just got a quote for this year: $6,394.

- “It’ll probably double for next year” — but then go down, Lucas says.