Auto insurance and tort-reform groups are keeping their fingers crossed after a second Florida House subcommittee approved a bill that would ban assignment-of-benefits agreements for windshield repairs, a measure that proponents hope will stem a flood of litigation aimed at insurers.

“Any attempt by a policyowner to enter into such assignment agreement is void and unenforceable,” reads House Bill 541.

The bill was approved by the Insurance and Banking Committee earlier this month. This week, the a subcommittee of the Civil Justice Committee endorsed it.

“What started as a small regional problem with a few lawyers and auto repair shops proliferated throughout the state as more unscrupulous actors looked to cash in,” said a statement from Fix the Cracks, a coalition of the Personal Insurance Federation of Florida, the National Insurance Crime Bureau, Florida Justice Reform Institute and other groups.

The bill is sponsored by Rep. Griff Griffitts, R-Panama City.

Most Floridians will have heard or seen advertisements from windshield repair firms, offering steaks or other gifts for motorists who have their windshields replaced. A similar bill in the Senate, Senate Bill 1002, would bar that practice, as well. That bill was approved last week by the Senate Commerce and Tourism Committee.

t’s far from certain that one or both bills will pass both chambers, insurance industry lobbyists have said. Insurance and tort-reform organizations have worked for limits on AOBs for several years, for property insurance claims and for auto insurance claims. The Florida Legislature in December barred AOBs for property claims, part of a broad effort to stem insurance claims litigation in the state.

“While progress has been made in Florida to address the state’s deepening property insurance market crisis, there is also a crisis in the auto market,” the Fix the Cracks coalition said.

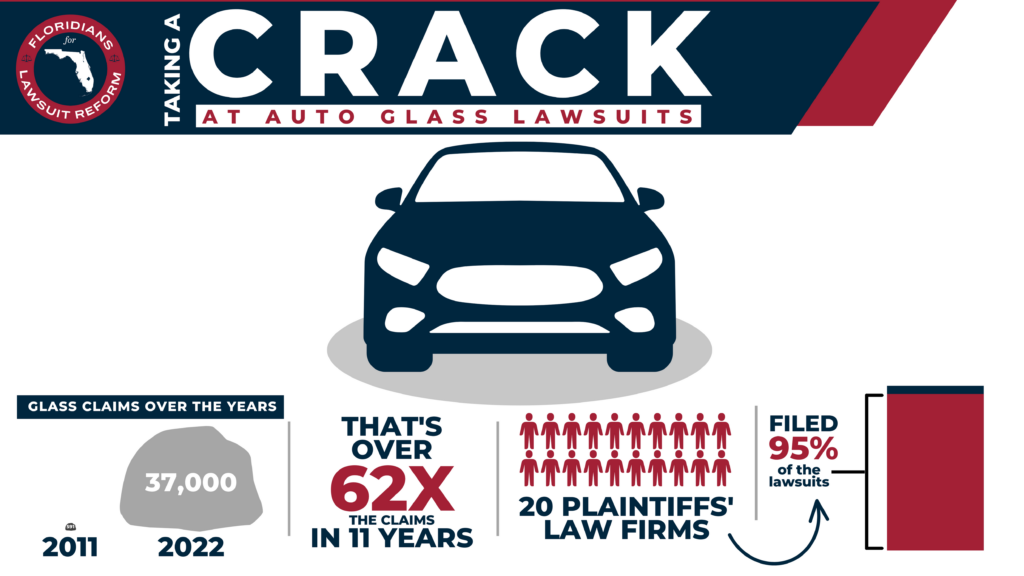

The coalition said that the AOB statute has incentivized law firms to file thousands of lawsuits against insurers over auto glass claims in recent years. The number of suits has jumped from 591 in 2011 to more than 37,000 in 2022. Some 20 plaintiffs’ law firms have filed 95% of the lawsuits, the coalition noted, based on data from the Florida Department of Financial Services.

“In Florida, we have a litigation crisis. It should not be a normal course of business when a client walks in the door that you expect to file a lawsuit,” said Rep. Tom Fabricio, R-Miami.

Some auto glass company owners spoke against the bill in the House subcommittee.

“If this goes through, it’s very simple, shops like mine would be out of business on day one, if you took away AOB and one-way attorney fees,” said Bill Camp, owner of At Home Auto Glass, with shops in Sarasota and Tallahassee.

He said he did not want to litigate claims, but has been forced to when insurers didn’t pay the standard fees on windshield work.

If the bills pass both chambers and are signed into law, they will take effect July 1, 2023.