NORTH PORT, Fla. — Florida’s property insurance crisis has left thousands of homeowners with open damage claims, struggling to find new insurance, six months after Hurricane Ian hit Southwest Florida.

At the end of February, United Property and Casualty Insurance, UPC, was the tenth property insurance company to go insolvent in recent years, meaning the company doesn’t have enough funding to cover current policies and claims.

Several UPC customers and insurance agents have reached out to ABC Action News In-depth Reporter Stassy Olmos, worried about their open damage claims from the hurricane, with the company’s coverage officially ending on March 29.

“I’m stressed to the point where I’m physically ill now,” said North Port homeowner Melanee Packard. “I think I’ve given myself an ulcer over this, over the stress of this is my home. This is what I have besides these two amazing kids. This is all I got.”

Packard has owned what she called her paradise in Southwest Florida for 30 years. She’s been paying UPC thousands of dollars for property insurance for about a decade.

“They detected mold, and the crack was on this outer wall, and if you look up at the ceiling, you can see the crack, it all cracked,” she showed Olmos.

Hurricane Ian cracked an entire wall and ceiling of a room, damaged her pool and roof, and tore her wooden fence into pieces. It loosened her doors and flooded the foundation of her driveway. She later found water spots on her ceiling and several species of mold growing.

The damage she said she only discovered after hiring her own public adjuster, as many hurricane victims have done.

“The public adjuster found water spots on my brand newly painted ceilings… because the roof wasn’t tarped until the public adjuster came in,” she said as she pointed out water spots in the living room.

According to the UPC claim document, an adjuster with the company came out within two weeks of Hurricane Ian.

“We didn’t even know what was damaged to the full extent that point,” Packard exclaimed.

Packard works for a company that builds affordable housing and has spent months getting estimates for repairs through vendors she knows. She estimates the cost to fix her home is around $40,000.

With a $6,000 deductible, UPC sent a check for $1,882 dated November 12.

“I almost fell on the floor. I tried contacting them, no one returns a phone call,” Packard said angrily.

She shared an email from UPC that states her “settlement documentation” is attached, dated October 31. She responded that she did not accept the claim and said it was her last correspondence with the company.

In February, the Insurance Information Institute (III) told Olmos that they were fielding the same concerns about UPC.

“They are dragging their feet on thousands of claims across the state,” said III Spokesperson Mark Friedlander. “We’re hearing similar stories from homeowners and insurance agents about no response from the company.”

On February 15, Olmos emailed UPC executives asking about the claims concerns. She did not receive a response.

At the beginning of March, Packard received a letter from the state’s Office of Insurance Regulation (OIR) stating UPC will be liquidated and her policy would be canceled on March 29.

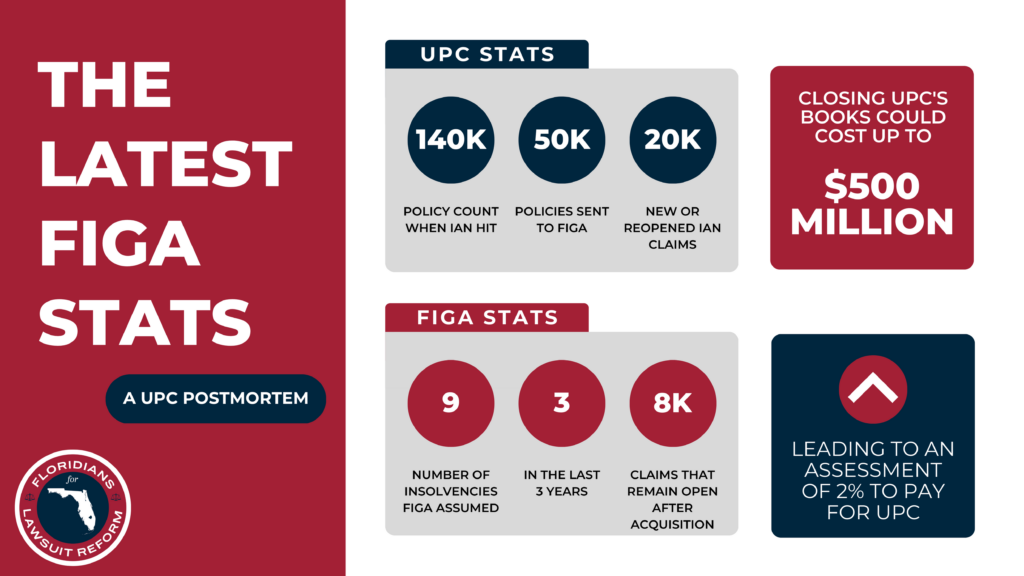

According to OIR documents, UPC had about 140,000 policies when Ian hit.

Olmos reported in February that a new insurance company, Slide, picked up nearly 90,000 policies from UPC before the company went insolvent. Slide took policies that fit their portfolio, which did not include policies with open claims.

That left about 50,000 policies going to Florida’s Insurance Guaranty Association (FIGA), a nonprofit funded in part by insurance companies, liquidated assets, and, if necessary, assessments on consumer insurance bills.

“We’re going on the assumption that we’re going to get 16,000 existing claims, and we’re expecting 4,000 new claims or reopened claims,” FIGA CEO Corey Neal said told Olmos in an interview in March.

“This is one woman and you are telling me that there are 20,000 people like her?” Olmos asked.

“Yeah, there’s a lot of people impacted, especially in that area,” Neal responded.

FIGA has taken on policies from nine property insurance insolvencies in the last three years. Neal said they still have 8,000 claims open.

The good news for UPC customers is that FIGA plans to start their claims process by the first week of April and hopes to have started correspondence with policyholders by April 7, Neal said.

“And that’s huge compared to previous insolvencies — you guys weren’t able to move that quickly,” Olmos expressed to Neal after covering stories where homeowners were stuck with open claims and no insurance for months on end.

“We were able to do some pre-planning and get ahead of some things,” Neal explained. “What makes this insolvency unique is that we use some of the same vendors UPC did as far as claim handling so that 16,000, we think 8,000 of them will be able to stay with the same adjuster that was handling the claim.”

It’s encouraging news, but homeowners like Packard are worried they won’t be able to get new insurance heading into another hurricane season.

“We’re in fire season. We had a fire three blocks four blocks that way and literally, I had pictures of these giant embers this big float around our neighborhood on fire. I have a plastic-covered roof!” Packard stressed.

“I live here. I work here. It’s the safe place for my kids,” Packard said, “And it doesn’t feel very safe right now.”

Packard set up a GoFundMe to help raise money to cover repair costs.

FIGA estimates closing UPC’s books will cost around $500 million. They’ll do this by liquidating UPC’s assets to pay back premiums, but Neal said they’ll also need to take out bonds to cover claims.

The association pays back bonds by assessing insurance policiesand charges that have been on consumers’ bills for the last few years.

On a current insurance bill, you’ll see two charges labeled “FIGA assessments,” totaling 2%. A 1.3% assessment for last year’s insolvencies is set to end in June, but Neal said they plan to extend that charge to cover UPC.

Olmos went to the state-backed insurer of “last resort,” Citizen’s Property Insurance Corps, to ask if they could do anything to help take on UPC customers with open claims.

A spokesperson for the company said they are making the process easier, stating, “Some required documents needed for new-business submissions are being deferred for up to 60 days,” adding that they understand repair time may take longer than 60 days, so a signed contract by a building professional would suffice for coverage.

Here are the full details on obtaining coverage from Citizens Property Insurance:

“First, we encourage customers to seek coverage from an authorized insurer that meets the 20% eligibility rule. Depending on the nature of the damage, it may be unlikely that other insurers would be willing to insure the home.

Citizens is making it easier to make an application for coverage. Some required documents needed for new-business submissions are being deferred for up to 60 days. These include:

- Four-point inspection form

- Roof condition documentation

- Current Uniform Mitigation Verification Inspection Form (OIR-B1-1802)

As a reminder, Citizens has statutory maximums on coverage limits: Any risk in any county (except Miami-Dade or Monroe counties) that has a dwelling replacement cost of $700,000 or more, or a single condominium unit that has a combined dwelling and content replacement cost of $700,000 or more, is not eligible for coverage with Citizens.

For risks with existing unrepaired damage or an open Ian claim, FIGA (up to its limits) is responsible for claims payment. For Citizens, the risk must be submitted by an agent unbound so that Citizens may assess the risk before approval. This documentation is required:

- Photos of the existing damage

- Document(s) reflecting when the repairs will be completed

- Existing damage written disclaimer from the applicant

It is important to stress here that the documentation outlining the plans to repair are critical. A signed contract by a building professional would suffice. We understand that the repair time may exceed 60 days, but having a plan to repair the dwelling is important.

Approval will depend upon the extent of the damage and the details of the plan to repair.”