Reforms put in place in the closing weeks of 2022 and proposed in the first quarter of 2023 suggest Florida is now quite serious about fixing the fraud and legal system abuse that have contributed to the state’s insurance crisis.

It will take years for the impacts of fraud and legal system abuse

to be wrung out of the system and for policyholders to experience premium benefits. Job 1 is to “stop the bleeding” as insurers fail, leave the state, or stop writing critical personal lines coverages like auto and homeowners.

But these measures and proposals would address the two top contributors to the crisis: legal system abuse and misuse of assignment of benefits (AOB).

“These two factors are creating a lose-lose, contributing enormously to the net underwriting losses for the few remaining insurers in the State,” says Triple-I CEO Sean Kevelighan. “What’s even worse is that insurance is becoming not just unaffordable, but also unavailable for homeowners and drivers.”

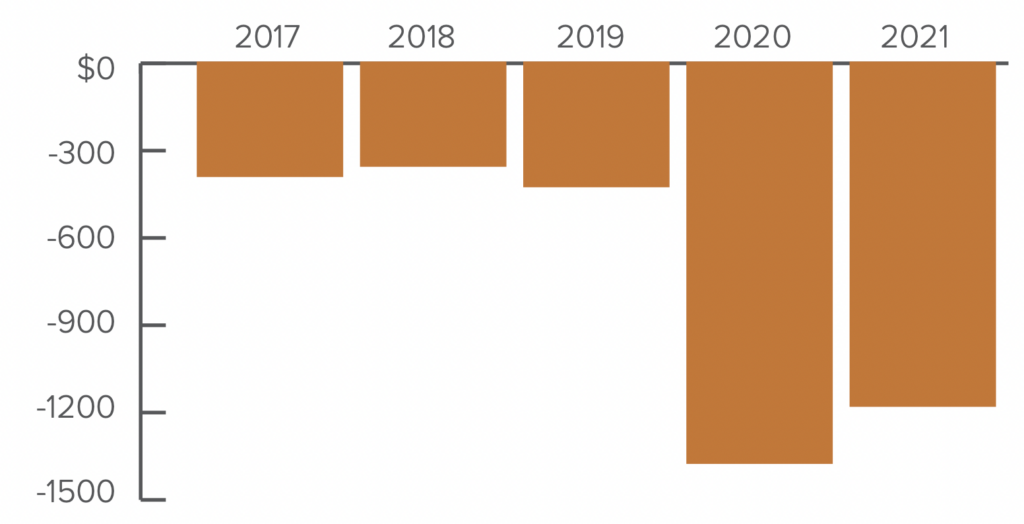

The industry experienced two straight years of net underwriting losses exceeding $1 billion in Florida and expects heavier losses when 2022 results are tabulated. Six insurers became insolvent in 2022, while more than a dozen others either left the state or placed moratoriums on writing new business. Average annual premiums have risen to more than $4,200 – triple the national average.

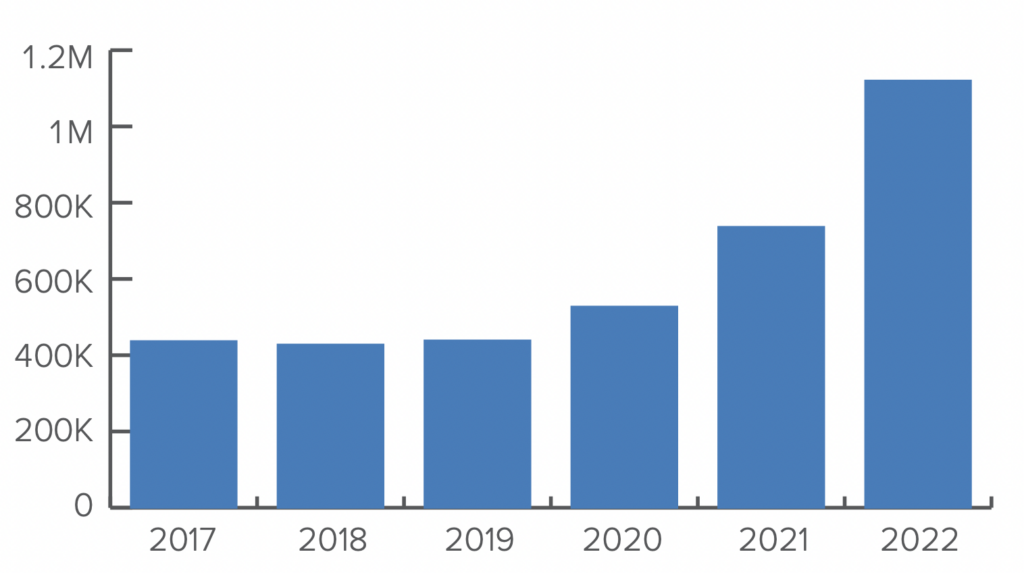

As insurers fail or leave, Citizens Property Insurance Corp. – the state-run insurer of last resort – has swelled with new business and

property claim lawsuits. Citizens had 1,145,178 policies at year-end 2022, up nearly 50 percent from the 759,305 policies in force at year-end 2021. The company forecasts about 1.7 million customers by year-end 2023, which would be its highest level of policies

on record. In fact, the company’s market share is more than 50 percent higher than any private insurer operating in Florida.

Additionally, Citizens has boosted its legal defense budget to roughly $100 million annually and has more than 20,000 open lawsuits pending.

One-way fees = loophole for AOBs

Legislation approved during Florida’s late 2022 special session eliminated “one-way attorney fees” for property insurance claims. Before the reform, state law required insurers to pay the fees of policyholders who successfully sued over claims, while shielding policyholders from paying insurers’ attorney fees when the policyholders lose.

The legislation also eliminated AOBs – agreements in which property owners sign over their claims to contractors, who then work with insurers. AOBs are a standard practice in insurance, but in Florida this consumer-friendly convenience has long served as a magnet for fraud. The state’s legal environment – including some of the most generous attorney-fee mechanisms in the country – has encouraged vendors and their attorneys to solicit unwarranted AOBs from tens of thousands of Floridians, conduct unnecessary or unnecessarily expensive work, then file lawsuits against insurers that deny or dispute the claims.

As private market suffers, burden on state-run backstop grows

Performance of Florida Domestic Property Companies

Net underwriting losses (as of 1/30/22, US $ millions)

Citizens Property Ins. Corp. Homeowners’ Policies in Force

(as of 12/31 for each year shown)

As a result, Florida accounts for nearly 80 percent of the nation’s homeowners’ insurance lawsuits, but only 9 percent of all homeowners’ insurance claims, according to the state’s Office

of Insurance Regulation. Eliminating these two mechanisms for property claims addresses much of the insurance fraud in the state.

But Gov. Ron DeSantis is asking that the legislature go further. The governor has proposed to eliminate one-way fees, AOBs, and legal fee multipliers for all lines of insurance “to permanently disincen- tivize frivolous lawsuits and realign Florida’s insurance market to promote more competition.”

Litigation reform not retroactive

It’s important to note that the reforms in this legislation are

not retroactive. All personal and commercial policies in force before Jan. 1, 2023, will fall under the previous regulations. This includes a large volume of disputed claims related to Hurricane Ian, which could drive total insured losses from the Category 4 major hurricane as high as $60 billion – the second largest U.S. catastrophe loss event on record.

“There are more than 100,000 assignment of benefits lawsuits working their way through the Florida court system,” said Mark Friedlander, Triple-I director of corporate communications. “These are primarily non-catastrophe losses. It will take up to five years for them to clear through the system. As a result, these expenses will continue to hit the bottom line of insurers.”

Friedlander added that more litigation-generated failures of Florida-domiciled residential insurers are possible.

Auto remains a problem area

Homeowners’ insurance isn’t Florida’s only troublesome line. When it comes to personal auto, although Florida is a “no-fault” state – meaning both parties in an accident submit claims to their own insurer, regardless of fault – it ranks high for attorney involvement in accident claims, the Insurance Research Council (IRC) has

found. Attorney involvement is associated with higher costs and settlement delays, and IRC also has found Florida to be among the least affordable auto insurance markets.

Here, again, AOB plays a key role. The Florida Legislature passed AOB reform in 2019, but the measure didn’t include claims for auto glass damage. Over a 10-year period, the number of auto glass lawsuits in Florida jumped by more than 4,000 percent, from 591 in 2011 to 28,156 in 2021, according to a database maintained by Florida’s Department of Financial Services.

An analysis by the National Insurance Crime Bureau (NICB) found that Florida had the highest number of questionable auto glass claims among the 50 states in 2020, accounting for nearly three- quarters of such claims, with 497,251 claims.

“Windshield replacement lawsuits continue to swamp the courts,” said William Large, president of the Florida Justice Reform Institute. “Many of these lawsuits even happen without the policyholder’s knowledge or informed consent.”

NICB, the Florida Justice Reform Institute, and the Personal Insurance Federation of Florida have launched a campaign called Fix the Cracks to warn consumers about growth in auto glass litigation.

Florida’s 2022 insurance reforms don’t affect the auto line of business. An auto insurance reform bill approved by the state legislature in 2021 – that would have required motorists to carry a minimum of $25,000 in bodily injury coverage for the injury or death of one person and $50,000 in coverage for the injury or death of two people – was vetoed by Gov. DeSantis because it would have raised rates for the majority of Florida drivers.

State legislation proposed in January 2023 would prevent motorists from assigning their legal rights in auto claims to repair shops.

Upward pressure on rates remains

The 2022 legislation will move the Florida property/casualty market toward stabilization, but policyholders’ premium rates will not be coming down any time soon. In fact, rates will likely continue to rise. Triple-I projects an average statewide increase of 40 percent or more in 2023.

“The first goal of this legislation is to moderate rate increases,” Friedlander said. “If Florida could get into the high single digits, similar to the national average increase of 9 percent in 2022, that would be a big win in our eyes.”

The second goal is to achieve market stability, “so you can interest other companies in writing new home business” in the state, he noted. “A more robust market leads to more choice for consumers. More options will lead to more competitive quotes.”

The new legislation also provides $1 billion in taxpayer funds for

a program to provide carriers with hurricane reinsurance, which is coverage bought to help ensure they can pay claims. It would offer “reasonable” rates in a market where companies have complained about rising costs.