Fri, Dec 8, 20236 min read

Florida has long been a go-to destination for sun-seeking retirees, but a dark cloud has formed over the Sunshine State — and it’s forcing some residents to flee to greener pastures.

At the eye of the storm is a home insurance crisis that has been brewing for many years. Facing a steady stream of natural disasters — and the influx of costly insurance claims that come with them — home insurers in Florida have been left with two options: charge more in order to cover their claims, or stop providing coverage in the state.

Both of those options are having a severe financial impact on Floridians — especially retirees living out their golden years on a limited budget.

“Everything hardworking, aging people have earned will be wiped out. The people with the financial means will wait it out and gobble up everything,” Florida-based condo owner Giuseppe Trafficante told Newsweek. “This is America and the American dream is slowly turning into the American nightmare for the average Joe.”

Up against soaring insurance costs, some residents are now questioning: Is Florida still a safe place to retire? Here’s what is driving the crisis and how you can manage your costs.

An insurance market in crisis

Florida homeowners are paying an average premium of $4,218 for insurance, compared to the U.S. average of $2,777, according to insurance.com. Those averages are based on the following coverage: $300,000 dwelling coverage, $1,000 deductible/2% hurricane deductible and $300,000 liability.

Some residents in higher-risk areas close to the coast have to stomach insurance bills of almost twice the Florida average. Robert Kantor, a resident of Broward County, told Newsweek his homeowner’s insurance doubled to over $7,000 last year — and “with taxes at over $3,500,” he has to pay $10,000 just to stay in his home, which he finds “ridiculous.”

Without the 2% hurricane deductible, the average cost of home insurance is $2,426, but if you choose that option to save some money upfront, you’ll likely have to cover any future hurricane damages out of pocket.

There are multiple factors — both natural and man-made — that are driving costs up. First, extreme weather like hurricanes, tropical storms and flooding have triggered historically high catastrophe costs in recent years. And with sticky inflation, elevated interest rates, labor and material shortages, the property insurance claims caused by those weather disasters have grown more expensive.

Insurers in the state are struggling to cope with excessive fraud and costly litigation, often revolving around bogus property damage claims. Florida is said to account for 79% of all homeowners insurance lawsuits over claims filed nationwide — and yet Florida’s insurers receive only 9% of all U.S. homeowners insurance claims, according to the .

Up against such challenges, insurers have struggled to run viable businesses in Florida. Since 2017, 11 companies that offered homeowners insurance in the state went into liquidation, according to Florida CFO and State Fire Marshal, . Those still soldiering on have hiked their rates and become far more selective about what risks they’re willing to insure.

As a result, the number of Floridians turning to Citizens Property Insurance — the state-backed insurer of last resort — has ballooned. On Oct. 31, 2023, Citizens had over 1.3 million , with premiums at almost $4.6 billion and a total exposure of $586 billion. To cover its ever-mounting costs, Citizens is hiking its homowner premiums by an average of 11.5%, with policy increases coming into effect on Dec. 16.

Read more: Thanks to Jeff Bezos, you can now — without the headache of being a landlord. Here’s how

“No one wants to pay higher insurance rates, I don’t want to do that,” said Citizens Insurance president and CEO Tim Cerio. “But we are actuarially unsound.”

Now, the insurer of last resort is being probed by the U.S. Senate Budget Committee investigation to see if it has enough money in the bank to withstand future weather disasters.

“The Committee has significant concerns about how such an insolvency would affect not only the Florida real estate market, but also the broader economy and the federal budget,” wrote Committee Chair Sen. Sheldon Whitehouse (D-RI) in a letter to Florida officials, which he shared with . “Should Florida look to the federal government for emergency relief, all American taxpayers could be on the hook.”

Florida remains very popular among older Americans for many reasons: the warm climate, no state income tax, job opportunities, retirement amenities, and relatively low cost of living compared to other populous states like New York and California, to name a few.

But the insurance crisis is making people think twice about living in the Sunshine State, especially those living on a tight retirement budget. If you cannot comfortably handle your monthly housing costs, you may want to .

A California-born woman, who chose to remain anonymous, told Newsweek she moved to Florida seeking a “safe place to retire” with her husband after they both retired from the U.S. Navy. Now a widow, she said the cost of home insurance has become a “real dilemma” on her fixed retirement income — and that’s after paying off her mortgage.

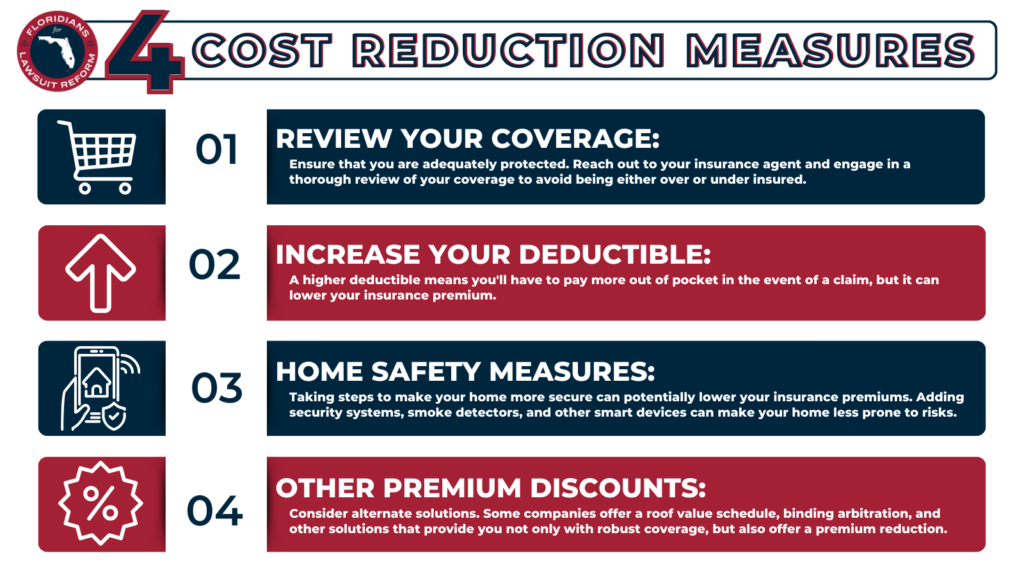

There are things you can do to improve your chances of getting a reasonable home insurance bill. For example, don’t just settle for the first you get. Shop around and compare multiple options to find the best coverage and the best price for you.

It can also help to spend a little on mitigation. Many insurers will give you a discount for installing water sensor technology to detect flooding. They will also recognize efforts to disaster-proof your home, such as installing backflow valves if your home is in a flood zone.

Finally, if you try to get around the insurance crisis problem by self-insuring your home, remember that you’ll be on the financial hook for any damages to your property, and you won’t have the support of an insurance organization to help you through the recovery and restoration process.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.