The Florida property and casualty insurance market is not out of the woods but it is showing signs of progress, from litigation trends to capital investments in the state, according to almost two dozen people who spoke at the Florida Chamber of Commerce 2023 Insurance Summit.

“The fact that more carriers are not afraid to try cases is something that’s very different than where we were just 10-15 years ago,” said Aram Megerian, an insurance defense attorney with the Cole, Scott & Kissane law firm.

Until the 2022 legislative reforms limited one-way attorney fees, ended assignments of benefits and made bad-faith claims a little more difficult to prove, some insurers found it more cost-effective to settle claims disputes or avoid going to a trial, even when the payout was more than carriers’ adjusters had determined.

“It didn’t make financial sense to try cases,” Megerian said at the Summit in Orlando on Thusday. “It’s not perfect, but now, we’re seeing that jurors are responding and are not trying to punish insurance companies.”

The speed with which plaintiffs’ firms have filed claims lawsuits after storms also has slackened, he noted. After Hurricane Irma in 2017, for example, an unexpectedly large number of suits were filed with three months. That time frame widened after Hurricane Ian hit in 2022. “That’s a positive sign,” he said.

And some judges have, own their own, have asked defense attorneys to weigh in on whether the legislative changes should be considered retroactive – affecting attorney fees for claims incurred before the 2022 reform law was adopted but in which suits were filed after the law took effect. After a 30-year period in which the Florida Supreme Court upheld case law that granted big fees and fee multipliers to plaintiffs, the recent question from a Florida appeals court is refreshing, Megerian said.

“The fact that they’re even asking that question without us raising it tells you where courts are going and what they’re thinking about,” he noted. “It’s a very positive change of events.”

Courts also have upheld option-to-repair endorsements and policies that put caps on water-damage losses, and have sided with insurers in a majority of recent suits that claimed extensive damage from leaky cast-iron drain pipes.

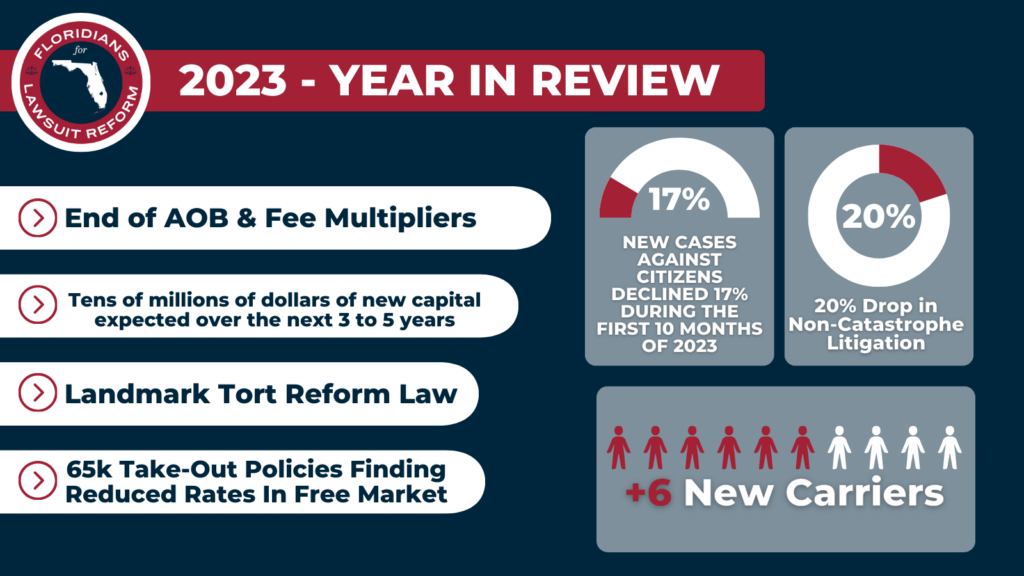

The landmark tort reform law approved by Florida lawmakers in 2023 took away large jury awards if plaintiffs or criminal parties are found to be partly responsible. That has given homeowner associations, businesses and apartment complexes “legs to stand on” in negligent security/injury claims, said Scott Shelton, managing partner with Cole, Scott & Kissane.

But the reforms, in the face of still-rising premiums for homes and businesses, have made it crucial for insurers to “do right” by insureds, the lawyers warned. “It’s more imperative now,” Megerian said.

On other fronts, trend lines are pointing in the right direction, experts said at the two-day summit.

Global capital investors and reinsurers are taking note of the new statutes and the insurance-friendly breezes blowing through the state, said John Seo, managing director of Fermat Capital Management, one of the largest investors in the Florida market, with $5 billion at stake.

“I think, gosh, what’s happened over the last year is something that many people thought would never happen,” Seo said. “I couldn’t be happier and I’ve been spreading the message worldwide to a global investor base that really is breathing a sigh of relief.”

Tens of millions of dollars of fresh capital are expected to flow into Florida over the next 3 to 5 years, he added.

For the state-created Citizens Property Insurance Corp., the number of non-catastrophe litigated claims have dropped 20% in the last year, Citizens CEO and director Tim Cerio said.

And the corporation’s depopulation plan is progressing as the market appears to be stabilizing. And some 65,000 insureds that have switched to take-out carriers are reporting that, upon renewals, their premiums actually dropped, much to the surprise of some in the industry, said Christine Ashburn, chief of legislative and external affairs for Citizens.

“You think, ‘Well, how could that be possible if Citizens’ rates are actuarily unsound?’” she said. “That is true on an overall book-of-business basis. But not true for every policyholder.”

A number of insurers in recent months have made take-out offers that target risks on which they can make a small profit and where Citizens’ rates are only about 10% below market rates in select parts of the state, Ashburn said.

Call it cherry-picking by private carriers, but the system is working as intended, she noted. One indicator: The share of the market held by “pups,” Florida-only subsidiaries of the largest U.S. carriers, has dropped from 35% in 2004 to about 15% this year as new carriers come into the state.

Citizens researchers who track industry numbers also had good news for the rest of the Florida market. Underwriting losses for selected insurers in the third quarter of this year were half of what they were in Q3 2020. Net losses also were down significantly while surplus and contributed capital has climbed.

“We don’t want to see the red, but the red is better than it was,” Ashburn said.

Speakers at the summit agreed that years of spiking insurance premiums have had an impact on Florida’s economy, including real estate, and have put new pressure on agents and brokers to consider all angles for savings for their clients.

One Florida air-conditioning and heating contractor, for example, for years paid only about $2,000 in annual premium on his shop and warehouse, explained Erik Johnson, owner of Gator Commercial Real Estate. But last year the contractor’s premium shot to $85,000, forcing him to add $100 to every repair or installation job.

“It used to be insurance was sort of an afterthought,” Johnson said. Now, real estate brokers have to consider premiums as a big part of the final cost and a potential deal breaker.

Buyers and companies that are expanding have moved toward higher deductibles and lower policy limits, and lenders in many cases have accepted those lower limits, explained Stephen Mostella, vice president of underwriting for Citizens. More companies have moved to self-insure or to drop wind coverage, said Alex Shouppe executive vice president of Brown & Brown Insurance of Florida.