News4Jax: May 3, 2021 4:14 pm

Mike Vasilinda

TALLAHASSEE – Homeowners are experiencing sticker shock as home insurance rates are rising rapidly in Florida.

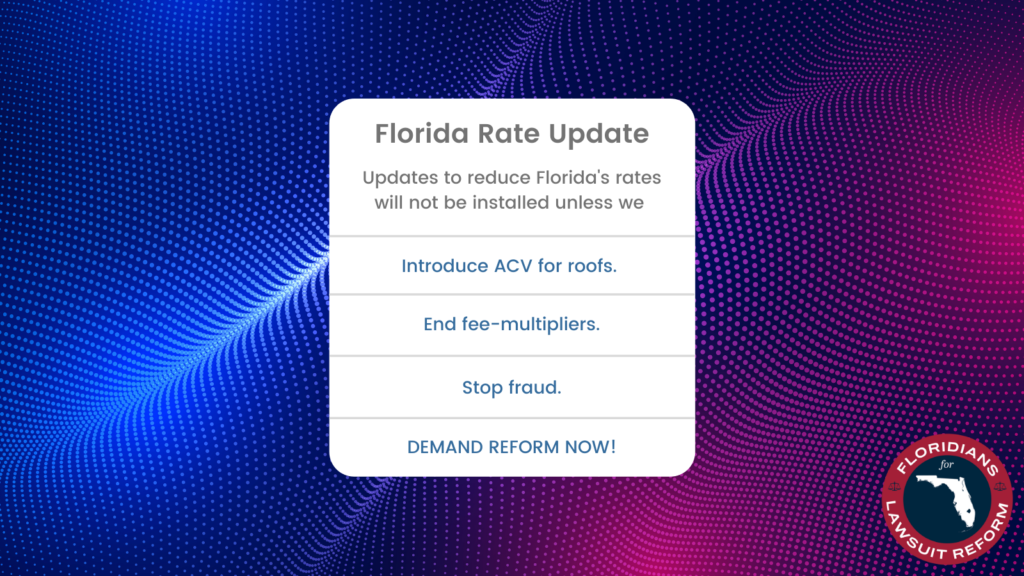

New reforms designed to lower rates take effect July 1 unless they’re vetoed by Gov. Ron DeSantis. But it could be more than a year before rates stabilize.

Florida’s 6.2 million property insurance customers are seeing double-digit hikes for homeowners insurance, and reform legislation doesn’t deal with one of the biggest cost drivers.

”Roofs are covered under the amendment, just like they have been in the past in your homeowners policy,” said Senate sponsor Jim Boyd.

Co-sponsor Sen. Jeff Brandes explained lawmakers couldn’t agree on a sliding scale to replace a roof based on its age.

”What they see as roofs are getting older, they are having to replace these roofs that are 20 years old that were frankly at the end of their useful life anyway,” said Brandes.

The legislation also makes significant changes to the way attorneys are paid.

“If everybody’s reasonable, then everybody pays for their own attorneys fees. Before it was if you got one dollar more, then the insurance company had to pay all the legal fees,” said Brandes.

Even supporters have said it’s going to take 18 to 24 months for the legislation to make a dent in rates. Democrats tried freezing current rates while the changes take place.

”And lets make sure it saves consumers money and doesn’t create more profit for an industry,” said State Sen. Janet Cruz.

It failed. House Democrats told said they believe the rejection makes the legislation one-sided.

”It’s a bill that’s really meant to put as much money into an insurance company’s pockets as is humanly possible,” said Rep. Evan Jenne.

Under the legislation, homeowners have to accept a quote from a private insurer, even if it is up to 20% more than the state’s insurer of last resort.

The legislation also prohibits third party adjusters from offering incentives to inspect your roof, and gives penalties to those who skirt the law.