Democrats call the reform a bailout for insurers that will raise homeowner premiums. The truth is that it fixes a legal racket that allowed windfalls for trial lawyers that have caused homeowner insurance premiums to spike and caused numerous insurers to become insolvent and exit the market.

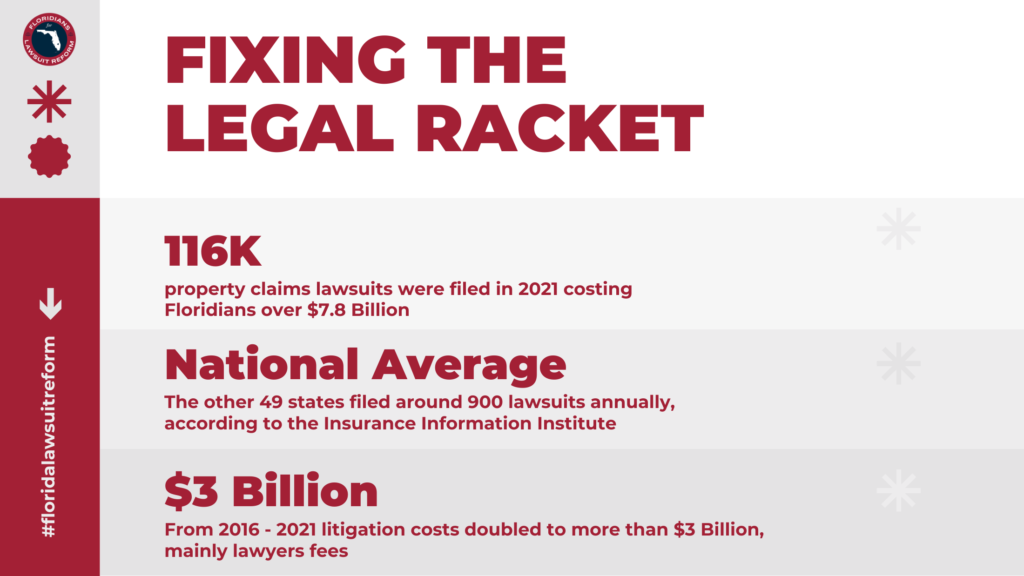

Florida insurers faced more than 100,000 lawsuits last year claiming $7.8 billion in damages, while the other 49 states faced a total of 24,700 claiming $2.4 billion. Between 2016 and 2021, property insurer litigation costs doubled to more than $3 billion. Hurricane risk is partly responsible. But so are plaintiff attorneys’ fees, which account for 71% of insurer legal costs while only 8% has gone to policy holders.

The reason? Florida law has allowed policy holders who want to avoid dealing directly with their insurance companies to assign their claim benefits to contractors who work with trial lawyers. The contractors would often inflate charges, which were often rejected by insurers. Attorneys then sue insurers to obtain what they say are legitimate charges. Insurers have been required to pay the attorneys’ costs if they lose a case. As a result, insurers have been inundated with frivolous lawsuits.

Many insurers have settled and raised premiums to cover legal costs and risks. Florida’s property insurance premiums are the highest in the U.S.—$4,231 on average annually—and nearly triple the U.S. average. While the Sunshine State’s low taxes have attracted newcomers, high property premiums are making it less affordable to buy and own a home.

Insurers are also struggling to price legal risks and had underwriting losses exceeding $1 billion each of the past two years. More than a dozen insurers have failed since early 2020 while a growing number are pulling back from the market because they can’t get reinsurance.

Homeowners have increasingly turned to state-backed Citizens Property Insurance Corp., which offers below-market premiums. Citizens’ number of insured properties has doubled since September 2020 and it has become the number one property insurer in the state. One bad hurricane season could wipe out its reserves, requiring a taxpayer bailout or other insurers to cover its liabilities.

The GOP reform eliminates assignment of benefit and the requirement that insurers pay plaintiff attorney’s fees if they lose. It also sets up a $1 billion state reinsurance fund to backstop insurers. Homeowners with Citizens policies will be required to accept private coverage from an insurer that offers premiums within 20% of its rates.

Citizens would ideally be required to charge closer to market rates, and the policy goal over time should be to eliminate any state insurance backstop. But this reform makes progress that is intended to attract more private insurers by creating a stable legal environment that should lead to more insurance competition.

Insurance reform is politically difficult, as Congress repeatedly proves by failing to fix federal flood insurance. Florida’s reform shows Tallahassee can address a broken insurance market in a way that should help consumers and taxpayers.