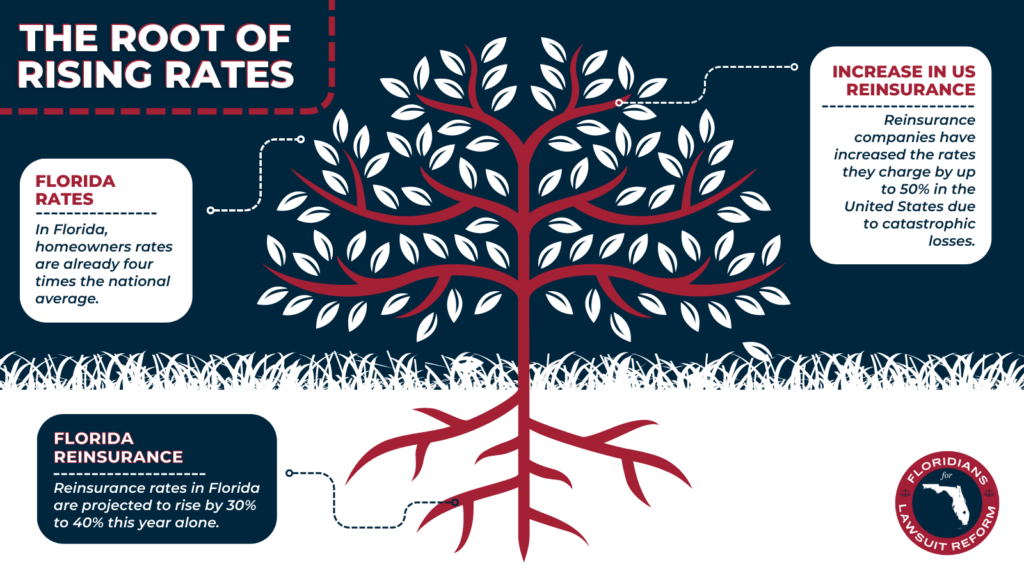

Companies that sell insurance to other insurance companies are raising the rates they charge in the event of catastrophic losses by as much as 50% in the United States, according to a report released Monday by the reinsurance firm Gallagher Re.

Reinsurance companies are the fallback for insurance giants like State Farm or Progressive in the event of catastrophic losses. As wildfires and floods ravage vast swaths of the nation, the possibility that homeowners could make insurance claims en masse is higher than ever.

Reinsurance rates rose between 30% and 50% in the United States during the July 1 renewal cycle, Gallagher Re said in its report.

Reinsurers are raising prices as their own costs rise, the report said.

“Reinsurance rates are generally on the increase as reinsurers have not been covering the cost of their capital for a number of years” Gallagher Re’s International Chairman James Vickers said in an email.

Insurance companies are offering more payouts to homeowners dealing with the natural disasters and extreme weather brought on by climate change.

Gallagher Re’s report also singled out the healthcare market as a driver of increased costs.

Insurance companies ultimately pass on higher reinsurance premiums to their own customers, according to Reuters.

Vickers, however, noted that reinsurance is only one facet of primary insurance prices.

“Reinsurance cost clearly plays a role but there are other mitigating factors helping primary insurers to manage their primary rates and these include higher investment rates leading to better investment returns as well as changes in original policy terms and conditions such as increased retentions all of which help to mitigate primary rate increases,” he said.

Even so, the rising cost of insurance for homeowners is potentially dire.

State Farm and Allstate both said in early June that they will no longer provide homeowners or personal property insurance in California, a move that pushed up home values in what is already one of the most unaffordable states in the country.

Homeowners rates in Florida are already four times the national average, and reinsurance rates there are up 30 to 40% thanks to floods and natural disasters, Gallagher Re’s report said.

“All the major carriers (in Florida) left and so you ended up with this market which is populated by a large number of very small, very thinly capitalised insurers, which is exactly what you don’t want,” James Vickers, chairman international of reinsurance at Gallagher Re, told Reuters.

Some states like California have insurers of last resort, which generally have higher premiums and cover less than traditional insurance companies.