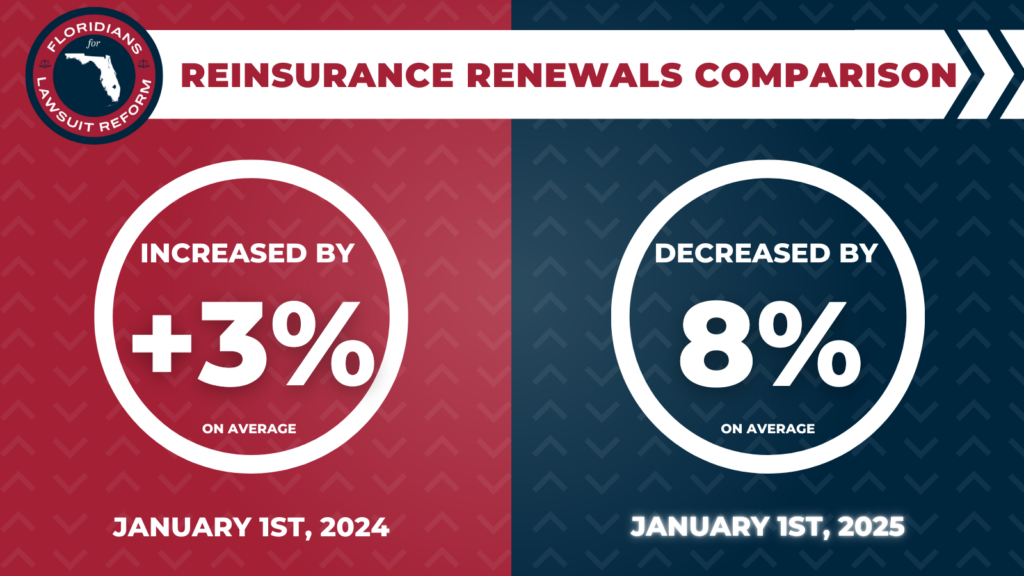

According to global insurance and reinsurance broking group Howden, risk-adjusted global property-catastrophe reinsurance rates-on-line decreased by 8% on average at the January 1st, 2025, reinsurance renewals, in comparison to +3% that was recorded last year.

In their January 1st 2025 reinsurance renewals report, Howden noted that demand at this years renewals was “strong once again, driven by higher exposures and asset values, and increased appetite across traditional and alternative markets drove an even bigger increase in supply.”

In spite of another year that saw elevated catastrophe loss activity, which was further aggravated by the late arrivals of Hurricanes Helene and Milton, favourable market conditions reportedly helped insurers to navigate the uncertainty around loss quantum to see property-catastrophe placements over the line, typically with sizeable rate decreases, Howden explained.

It’s worth highlighting, that annual insured nat cat losses to the private market in 2024 approached US$130 billion, extending the run of every year in the 2020s breaching the US$100 billion threshold in real-terms.

Focusing on US property cat reinsurance, Howden stated that early expectations for rate deductions at the renewals prevailed despite a period of uncertainty following Helene and Milton hitting Florida as major hurricanes late in the season.

The broking group also noted that sentiment for hardening in the initial days and weeks after landfall fell in line with diminishing market loss expectations for Milton in particular.

As well as this, Howden explained that supply remained sufficient to meet high demand, partly due to significant fund raising / reinvestment of retained earnings in the traditional and insurance-linked securities (ILS) markets, along with a few new entrants entered at 1.1.25.

Switching over to Europe, a combination of loss experience and oversupply shaped property cat renewals at 1.1, with loss-free programmes recording rate decreases of between 3% and 15% on average whilst recoveries in loss-affected regions resulted in a variety of pricing outcomes.

According to Howden’s report, demand for top-end protection in Europe remained strong and was met with ample capacity at 1.1.

“This typically resulted in meaningful rate reductions for higher layers, which had previously been driven up in the aftermath of Hurricane Ian. There was increased appetite from reinsurers to engage lower down programmes and to write aggregate deals, although capacity was more limited for cedents looking for frequency-based solutions. Some cedents were also able to reduce core catastrophe attachment levels to those bought prior to 2023,” Howden added.