The vast majority of New York’s trucking companies are small, family-owned businesses that have operated for generations. These are the unsung heroes of our supply chain, working tirelessly to ensure that goods and materials move safely, efficiently, and cost-effectively across the state. Yet, despite their critical role, our local carriers are under siege — not just from challenges like rising fuel costs and workforce shortages, but from a lesser-known but equally destructive force: nuclear verdicts fueled by third-party litigation finance agreements that are hidden from view in legal proceedings.

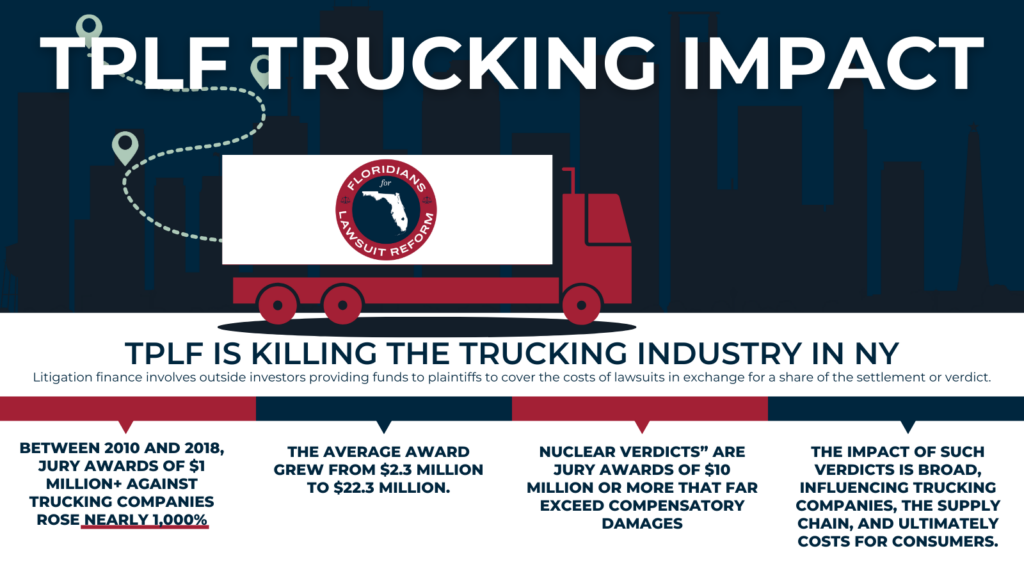

“Nuclear verdicts” are jury awards of $10 million or more that far exceed compensatory damages. The impact of these verdicts is widespread, affecting not just the trucking companies involved in litigation, but the entire supply chain and, ultimately, consumers. While local businesses and consumers suffer, the shadowy lawsuit funding industry is booming.

Over the past decade, nuclear verdicts have skyrocketed. Data from the American Transportation Research Institute shows that between 2010 and 2018, jury awards in excess of $1 million for trucking lawsuits increased by nearly 1,000%, with the average award jumping from $2.3 million to $22.3 million. These staggering figures are an existential threat to real businesses — often small, local companies — that can be driven to the brink of bankruptcy by a single lawsuit.

The rise of third-party litigation finance is a major factor behind this alarming trend. Litigation finance involves outside investors providing funds to plaintiffs to cover the costs of lawsuits in exchange for a share of the settlement or verdict. While this might sound like a way to level the playing field for plaintiffs, it creates an imbalance in the legal system and perverse incentives that inflate verdicts far beyond what is reasonable.

The ripple effects of these inflated verdicts are felt across the entire supply chain. Insurance costs for trucking companies are soaring as insurers struggle to factor in the risk of these silent financiers driving massive payouts. This, in turn, leads to higher costs for transporting goods — cost which are ultimately passed on to consumers. At a time when rising prices are already squeezing household budgets, the last thing New Yorkers need is another layer of costs driven by an unregulated, greed-driven industry.

Unlike insurance policies, which must be disclosed in court, litigation finance agreements are hidden from view, leaving judges, juries, and defendants in the dark about the who is underwriting, and at times directing the strategy, behind a lawsuit. This lack of transparency creates numerous issues, including potential conflicts of interest, confidentiality concerns, and the risk of usurious interest rates that prey on injured plaintiffs and further inflate settlements.

To protect New York’s trucking industry — and by extension, the state’s economy — we must bring transparency to litigation finance. Just as lawmakers in Albany have expanded the amount of insurance information disclosed in court, so too should litigation finance agreements. Sunlight is the best disinfectant, and by bringing these agreements out into the open, we can ensure a fairer, more balanced judicial process.

By acting now to bring transparency and fairness to the litigation process, we can protect these vital businesses, safeguard jobs, and ensure that our supply chain remains strong and resilient. The leadership shown by the New York State Legislature’s Transportation Chairs, Assemblyman William Magnarelli and Senator Jeremy Cooney, who carry bills to protect consumers from sky high interest rates, lays a strong foundation, but to build a truly just and effective regulatory framework, full transparency of litigation finance agreements must be an integral part of any final legislation. Without this transparency, the system remains skewed, with defendants, judges, and juries left unaware of the financial interests driving oversized verdicts.

New York’s trucking companies work hard every day to keep our economy moving. It’s time we ensured that they are treated fairly in the courtroom, with full transparency and a level playing field for all. The trucking industry is too important to New York’s economy to be left at the mercy of unregulated financiers.

Kendra Hems is president of the Trucking Association of New York.