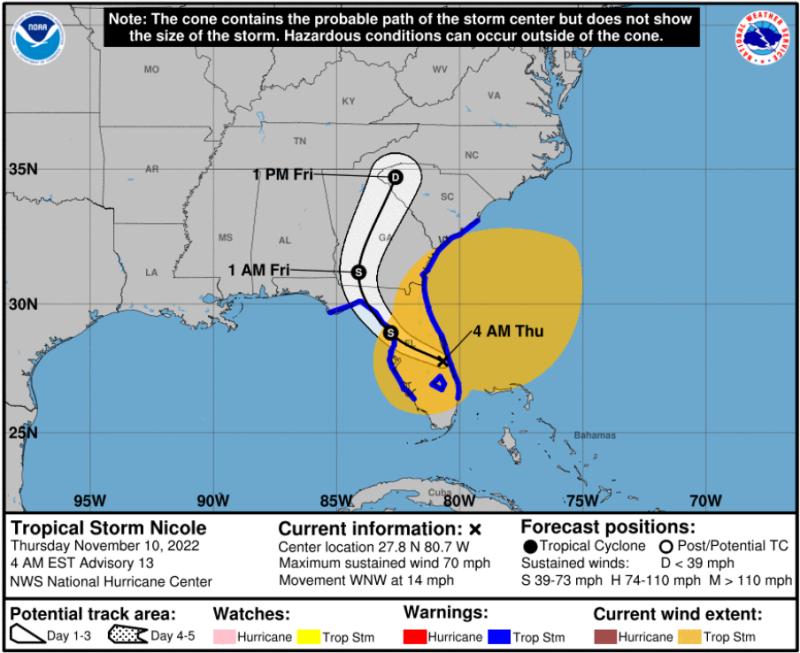

Nicole made landfall around 03:00 ET on the east coast of Florida on North Hutchinson Island, with sustained winds of around 75 mph, according to the National Hurricane Center. Under an hour later, Nicole had weakened into a tropical storm as it made its way over east-central Florida, bringing strong winds, heavy rains and dangerous storm surge.

This comes as the Sunshine State reels from Ian – a Category 4 storm that is projected to cost the market losses between $40bn and $60bn or more.

In a blog post, BMS senior meteorologist Andrew Siffert said that for Nicole, beach erosion and storm surge along the east coast landfall area will be the main source of damage but noted that with the storm having made landfall at low tide, and positive signs such as low levels of power outages, claims should be limited.

A recurrence of Cat 2 Hurricane Erin, which made landfall in the Vero Beach area in 1995, would cause losses of $1.1bn. Nicole was weaker but much larger, and higher deductibles now apply than in 1995, he noted.

“Still, this should be a retained event for carriers that provide coverage across the state with total industry losses over $500mn but likely less than $1.1bn.”

But sources noted that Nicole highlights how vulnerable the Floridians were after Ian, as a second major event would have wiped out the remaining reinsurance cover for many of the domestic carriers.

One carrier said they did not expect Nicole to represent an event of the scale that would drive full retention losses, but that claims would be “eating into whatever margin [insurers] had left this year”.

A further challenge for carriers in getting through next spring is that some reinsurers excluded severe convective storm coverage during this year’s renewals and should there be major storms this would also erode further surplus.

On its third quarter conference call, United Insurance Holdings (UPC) disclosed that personal lines losses from Ian nearly reached the top of its program, with $63.4mn of limit left from the Florida Hurricane Catastrophe Fund (FHCF) and $9.3mn from private reinsurers.

UPC CFO Brad Martz added that the company’s expected retention from a second event is estimated at $31.8mn, and that it had more substantial reinsurance support remaining for its commercial carrier American Coastal.

The other public Floridians reported Ian losses that did not reach this far into their programs.

Heritage management commented on the company’s conference call that its reinsurance cover for any upcoming loss over $20mn would be roughly 40 cents on the dollar, depending on the severity of a particular storm. They added that the maximum retention for a second event such as Tropical Storm Nicole is around $32mn.

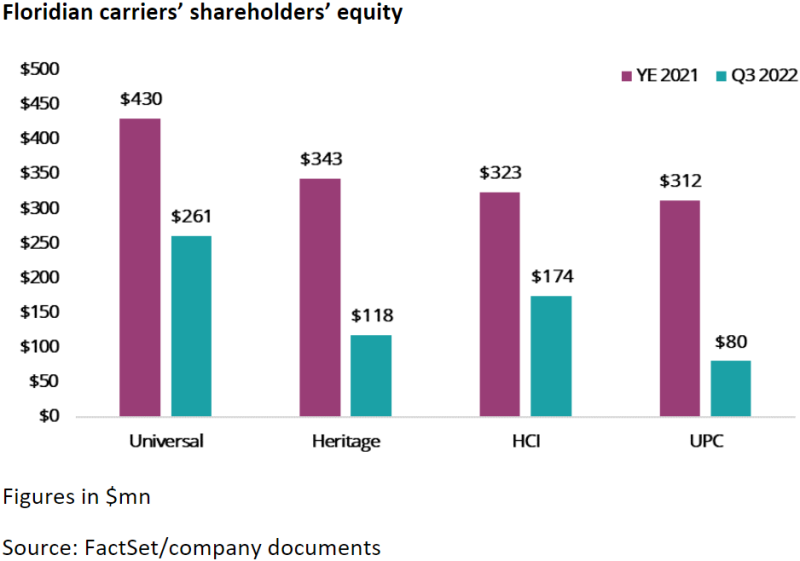

Heritage and HCI both discussed the potential to infuse further capital into their insurance companies before year-end on their earnings calls. HCI executives noted the firm has “more than enough capital available to do that” but that how much would be partly dependent on the outcome of legislative sessions.

On reinsurance, Demotech president Joe Petrelli said that the ratings agency may raise their coverage requirement for the upcoming 6.1 renewal from the current 1-in-130-year event requirement.

“It’s like if you have a home, you have to increase the value of that home every year. And if what we’re seeing here is more frequent storms of a more ferocious and expensive nature, then we have to make a good decision, regardless of the conditions in the marketplace,” he said.

Citizens CEO Barry Gilway added that companies would have to find a way to replace decreased surplus by replenishing it or reducing the premium.

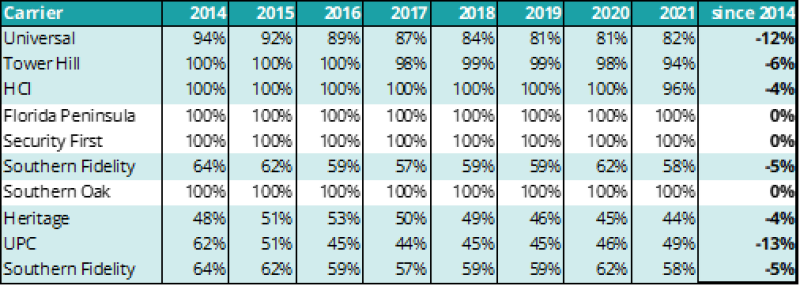

Cutting back premium income has already been a target for carriers that have halted writing new business in many counties across the state over the last year. Notably, Heritage, HCI, Southern Oak, Universal, Centauri and Bankers have all paused some form of underwriting.

Shift in premium from Florida to out of state (% of HO premium in FL)

Any additional pullback in premium will only funnel more policies into Citizens, which is projecting to reach 1.6 million policies sometime next year.

Sources also expressed concerns around the track that Nicole took, which overlaps with some areas that Ian hit.

“Some houses have been tarped and they’ll probably have to be re-tarped, and work will have to stop,” one of the sources said.

Another source quipped that tarps may have to stay up until the end of the year.

Hurricane Nicole’s Path

Source: National Hurricane Center

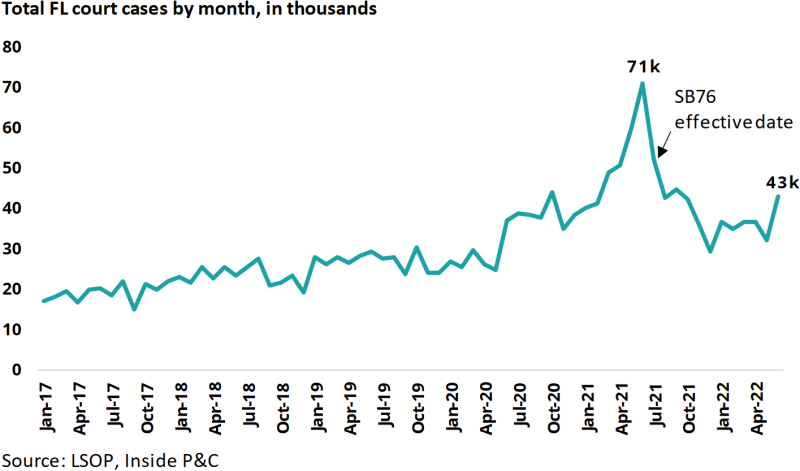

An important factor when considering any event in Florida is the scope for litigation, as even a weaker event such as Nicole could bring in claims. Sources pointed out that they see more litigation from the Seminole, Orange, Lake and Osceola (SOLO) counties, which are areas that both Ian and Nicole hit.

Data from Ian shows Orange, Seminole and Volusia counties reporting between 10,000 and 32,000 claims to the Florida’s Office of Insurance Regulation as of November 2nd, despite having experienced relatively low wind gusts of 60 to 70 mph during the storm.

Reform pace picks up

Hurricane Nicole will also underscore the urgency of further legal reforms, with a special session expected to be called in December after Governor Ron DeSantis swept to a re-election victory this week.

The two key targets on the agenda will be the removal of one-way attorney fees, which Florida CFO Jimmy Patronis had called for earlier this year and Florida Hurricane Catastrophe Fund (FHCF) reform.

Like the special session earlier this year, the agenda thus reflects a mix of both longer-term problem-solving and short-term aid, given the constraints on reinsurance appetite for Floridian risk.

Regarding the Cat Fund, the legislature could potentially lower the attachment point and provide expanded optional layers below Cat Fund.

This would complement this year’s new $2bn Reinsurance to Assist Policyholders (RAP) state reinsurance layer, which some sources said at the time it was announced in May would not go far enough.

Carriers have been struggling to fill lower layers of their reinsurance programs as reinsurance appetite for this risk has evaporated, with rates soaring to levels that effectively mean insurers are prepaying for their first losses.

This also contributed to the higher retentions taken by carriers on Hurricane Ian as some insurers put more of their first reinsurance layers into their captives.

Beyond state reinsurance support, the one-way attorney fee issue was one of the contentious issues that did not get addressed in the earlier reform bills and which alongside the assignment of benefits system is seen as a key driver of high litigation against Florida insurers.

The user of multipliers greatly contributes to the high degree of costs paid out by insurers straight to attorneys. As much as 71% of the total sums paid out by Florida insurers for litigated claims from 2013 to 2020 went straight to plaintiff lawyers, with 21% on defense costs, studies have shown.

Beyond improving the situation for primary carriers, this is also seen as crucial to encouraging more reinsurance capacity to return to the Florida market in the longer term.

“We have to prove to the reinsurance underwriters we’ve fixed the problem,” one carrier told this publication.