A Senate committee voted in favor Wednesday of confirming Tim Cerio, a veteran government lawyer, as CEO of Citizens Property Insurance Corp.

Members of the Banking and Insurance Committee had no questions for him before approving Cerio’s appointment by voice vote. He still needs to clear the Ethics and Elections Committee before qualifying for a Senate floor vote.

Committee chairman Jim Boyd, a Republican representing parts of Hillsborough and Manatee counties, expressed confidence in Cerio. “I think you’re absolutely qualified for this job,” Boyd said.

“For the economic wellbeing of the people of Florida, as well as the good of Florida insurance market, Citizens must return to truly being the state’s insurer of last resort,” Cerio told committee members before they advanced his nomination.

The Citizens board hired Cerio as CEO at the end of January, following the retirement as longtime chief executive Barry Gilway. Before that, Cerio served as general counsel to the company. He also has served in private law practice and as general counsel to former Gov. Rick Scott and the state Department of Health.

Cerio has seats on the Board of Governors of the State University System of Florida, the Florida Supreme Court Judicial Nominating Commission (JNC), and the board of the conservative James Madison Institute.

The JNC, by the way, is reviewing candidates to replace Supreme Court Justice Ricky Polston following his recent resignation from the high court. Cerio hired Polston without a formal candidate search for Cerio’s old job as general counsel to Citizens, at a considerable salary increase, from $227,217 (based on an April 2022 financial disclosure form), on the court to $450,000 at Citizens.

Polston was the second justice to move into lucrative private practice in seven months.

Rising rates

Addressing the Senate committee, Cerio said his priorities in the job would include finding private insurance for as many Citizens customers as possible; maintaining customer service; and avoiding assessments — meaning surcharges Citizens is allowed to attach to private insurance policies if its reserves run too low.

The company had nearly 1.2 million policies in force as of late February, compared to nearly 793,000 one year earlier, corresponding with the departure of private carriers from Florida amid an unsettled market.

He noted that last week Citizens asked the Florida Office of Insurance Regulation to approve a 14.2% premium increase for homeowners, condominium units, renters and mobile homes. The company is not supposed to undercut the private market but at the moment is charging 44% less than private insurers. The increase, if approved, would leave Citizens 36% below the private market, Cerio said.

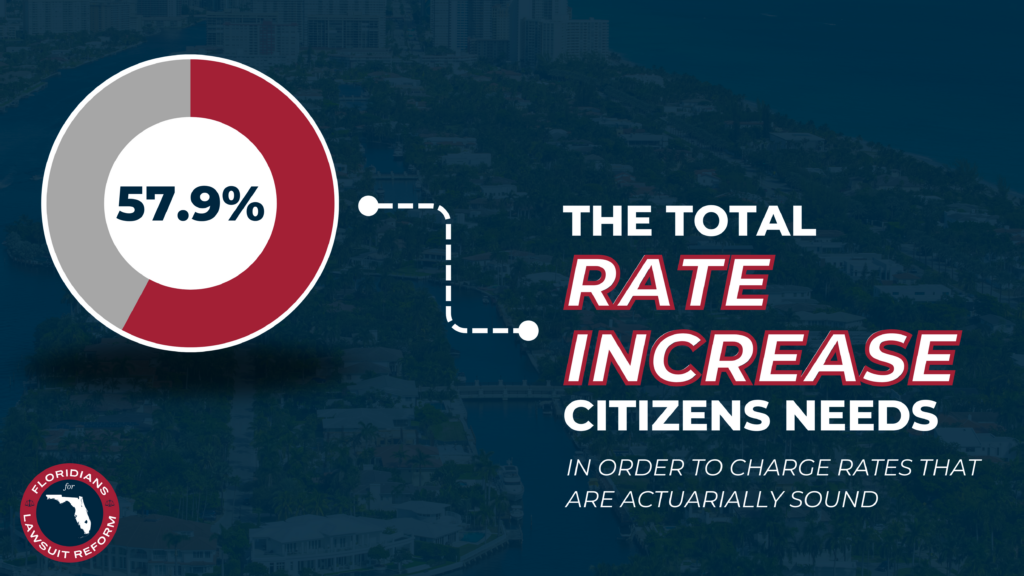

The company would need a rate boost of 57.9% to be actuarially sound, according to its records, although state law limits the size of hikes permitted to the company. The imbalance leaves Citizens vulnerable in case of additional disasters, which could force what Cerio called “hurricane tax,” or assessments.

He reckoned the Legislature’s recently passed limits on lawsuits against insurers will bolster Citizen’s soundness. “Just being able to spend less on litigation will enable us to have more for surplus,” he told the committee.