Hurricane season is coming in less than a month and it’s time to get ready. But Florida homeowners will soon have another chance for help from the state now that Gov. Ron DeSantis signed the bill adding $200 million in funding for the extremely popular My Florida Safe Home program.

The My Safe Florida Home (MSFH) program, which matches up to $10,000 of the costs Florida homeowners pay for home improvements designed to harden their homes against tropical storms and hurricanes, has run through fundingnearly as quickly as legislators could provide it. This year the Florida Legislature unanimously passed SB 7028 and bumped the original provisional funding from $100 to $200 million.

“We do realize that there’s a waiting list,” DeSantis said. “And I think it’s good they re-upped the program. If there was nobody signing up for it then they (the Legislature) probably wouldn’t have appropriated more money for grants. So there’s more help on the way.”

The bill also made several changes to the program, including streamlining the process and weighting new applications toward residents aged 60 and older, and residents who qualify as low- or moderate-income.

Here’s what changed, and when you can apply.

What is the My Safe Florida Home program?

The My Safe Florida Home Program was originally started in 2006 but the Republican-controlled Legislature stopped funding it about three years later. It was brought back during a 2022 legislative special session on the state’s property insurance crisis amid complaints over the state having the highest homeowner premiums in the nation.

MSFH provides eligible Florida homeowners with free home inspections for hurricane readiness and offers recommendations for wind mitigation features such as roofing materials, better exterior and garage doors, storm shutters, attachments for walls and roofs like hurricane clips and more.

Just getting the inspection can help homeowners save money on their insurance premiums, but homeowners who receive the wind mitigation inspection may also apply for matching grant funds to help pay for the recommended improvements, with the state matching $2 for every dollar the homeowners spend, up to a cap of $10,000.

Of the homeowners who have received grants, completed improvements and disclosed their insurance premium discounts, they report an average savings of $1,014 per year, the News Service of Florida said in 2023.

‘Hyperactive’ hurricane season ahead?Our models say count on it | WeatherTiger forecast

What types of mitigation projects are eligible for My Safe Florida Home grants?

ROOFS AND STRUCTURES

- Improving the strength of roof deck attachments

- Reinforcing roof-to-wall connections

- Installing a secondary water barrier for the roof

OPENINGS

- Upgrading exterior doors

- Upgrading garage doors

- Upgrading windows

Townhouses are now eligible for upgrades on openings (doors and windows) but are not eligible for roof repairs.

What changed in the My Safe Florida Home program in 2024?

Under the new changes, there are now application windows of specific dates to give low- and moderate-income Florida homeowners who are 60 and over first crack at home-hardening grants. Low-income grants were increased from $5,000 to $10,000, the MSFH said.

Homeowners also would be permitted to use any certified Florida state contractor for the recommended improvements rather than requiring them to choose from a state-approved list, and all grant money will be paid directly to the homeowner for disbursement. Grant-eligible improvements for windows and skylights were added.

The option for local governments and nonprofits to seek grants to help homeowners has been removed.

Other bills (HB 943/SB 988) exempted portions of My Safe Florida Home application information from public records requests, and HB 1029/SB 1366created a similar program for condominiums.

Who can apply for a My Safe Florida Home program grant?

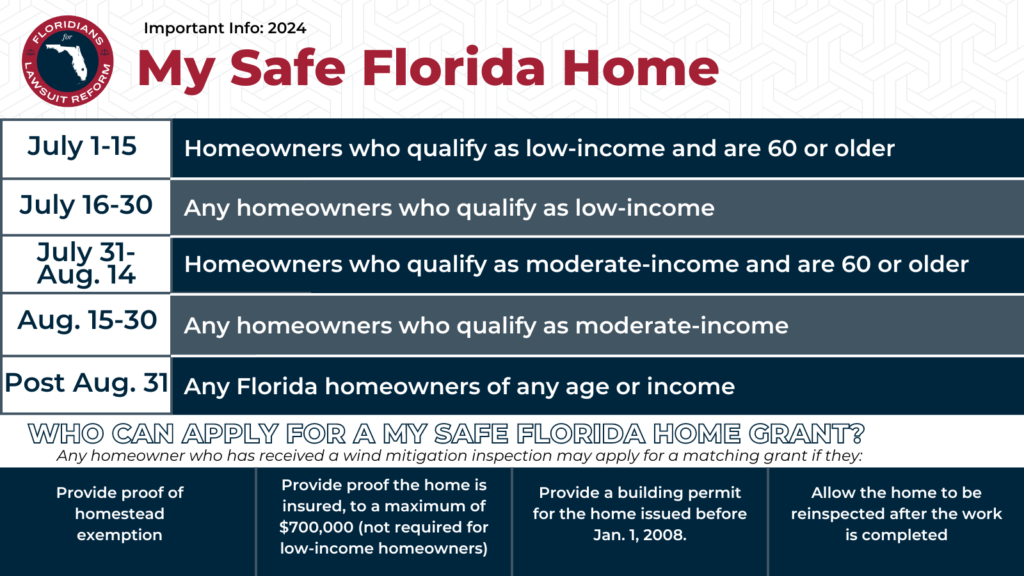

Any homeowner who has received a wind mitigation inspection may apply for a matching grant if they:

- Provide proof of homestead exemption

- Provide proof the home is insured, to a maximum of $700,000 (not required for low-income homeowners)

- Provide a building permit for the home issued before Jan. 1, 2008.

- Allow the home to be reinspected after the work is completed

Low-income homeowners who meet these qualifications are not required to provide matching amounts to receive the grant.

When can I apply for My Safe Florida Home grants?

Applications will reopen July 1, according to MSFH, and will be accepted and prioritized as follows:

- July 1-15: Homeowners who qualify as low-income and are 60 or older

- July 16-30: Any homeowners who qualify as low-income

- July 31-Aug. 14: Homeowners who qualify as moderate-income and are 60 or older

- Aug. 15-30: Any homeowners who qualify as moderate-income

- Aug. 31 and after: Any Florida homeowners of any age or income

What does Florida consider ‘low income’ and ‘moderate income’?

“Low-income persons” means they live in a household earning 80% or less of the median income for households in the county.

“Moderate-income persons” means they live in a household earning 120% or less of the median income for households for the county.

You can see a chart of those percentages county by county here.

How much money was allocated to the My Safe Florida Home program?

The program has received $215 million in funding since it was relaunched in 2022, with an initial $115 million and an additional $100 million added last June to the state’s fiscal 2023-2024 budget.

That money ran out last October leaving nearly 18,000 people hanging who had already submitted MSFH applications, but in November, during an emergency session, the Florida Legislature unanimously approved funding of $176.17 millionas part of a bill for hurricane relief to keep it going.

The new bill adds another $200,000,000.

How many people have used the My Safe Florida Home program?

According to My Safe Florida Home, the program:

- Accepted more than 150,000 applications

- Approved over 38,000 grants

- Completed more than 95,000 free wind mitigation inspections

- Allocated more than $332 million in state funds

The average disbursement in 2023 was $9,183 per homeowner, according to an analysis of SB 7028, and nearly 50% of the homeowners who completed the process saw a discount in their insurance premiums, with an average annual savings of $981.