TAMPA, Fla. — In our continuing coverage of the Price of Paradise, we’ve gone in-depth on Florida’s property insurance crisis as it unfolded over the past couple of years and resulted in two legislative special sessions last year.

As we wait to see the impact of the new laws, we’re finding that there are still people trying to take advantage of homeowners. This time it’s not roofing scams but misleading websites.

“This right here is all the keywords of a website that told me they were gonna stop attacking us, but they weren’t,” said Dan Block, who owns an insurance agency based out of Illinois. “They literally will say they’re another insurance company, and they’re not, or they’ll say they’re another insurance agency, and they’re not.”

Block’s agency is called Insurance King, and they write policies for companies in eight states, not including Florida.

That’s why he was dumbfounded to find a review for his agency on a website claiming to be Citizens Insurance in Florida.

“They literally have my real address and phone numbers and everything. It’s got my own personal name Daniel Block is on here,” he exclaimed.

But when you click for a quote, his website is nowhere to be found. Instead, it takes you to a site titled ‘Insurance Quotes.’

Florida’s property insurance market has been in a volatile state for years. It’s caused premiums in the private market to triple and drove more than a million homeowners to the state-backed insurer Citizens Property Insurance Corps. for coverage they can afford.

It’s possible impersonators are trying to take advantage of those looking for Citizens online.

ABC Action News In-Depth Reporter Stassy Olmos did some digging into the website.

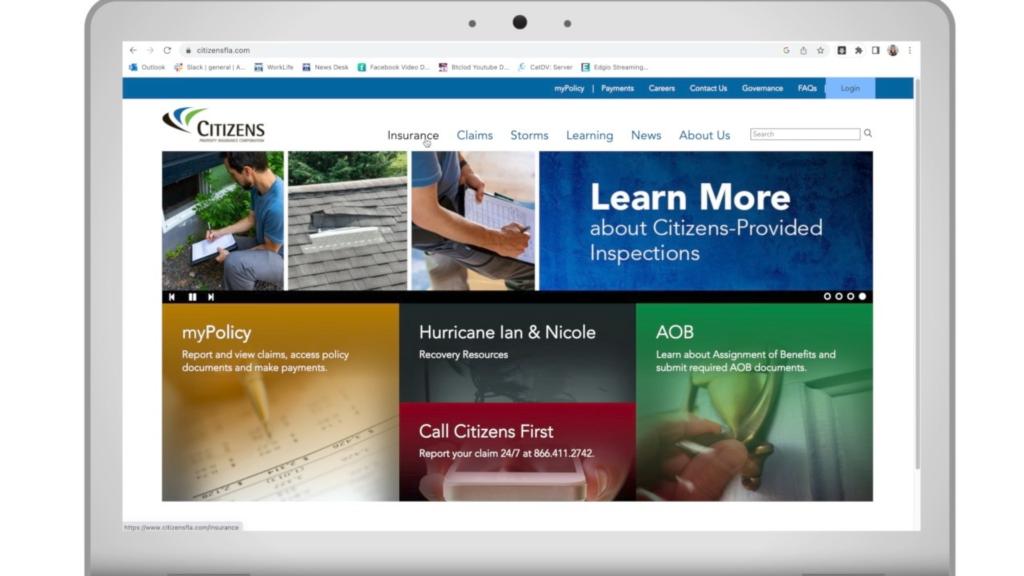

Its URL is: ‘CitizensInsuranceFlorida.com.’ The real Citizens is ‘Citizensfla.com.’

At first glance, the site’s logo looks exactly like the real Citizens.

The page claims to offer property insurance and car insurance with as little as a $20 down payment.

However, the real Citizens doesn’t insure cars, and if you click any of the links to get a quote, you’re taken to other sites where you’re asked for all kinds of personal information.

In the terms and conditions, the site claims to be part of LendingTree.

We looked up the owner of the site, and that’s when we discovered it was created in the last few years by someone in Iceland.

When we called the site’s number, it either disconnected immediately or was busy.

That’s when we went to the Better Business Bureau (BBB) to ask them to look into it. Bryan Oglesby with the BBB West Florida division said he connected with other divisions in North Carolina, where LendingTree is located, as well as Chicago, where Block is a member, to investigate this site.

“We reached out to LendingTree. We asked them if they were affiliated with this website. They told us that they were not,” Oglesby explained. “They actually have warnings on their website about fake websites that use their brand recognition to make them look legitimate.”

He added that the site appears to be spoofing several companies – including them.

“At the end, when you fill out a questionnaire form, it takes you to an end page that has actually the Better Business Bureau accredited business logo on it… spoofing the BBB’s good, recognized brand,” Oglesby said.

He said the end game of this site is either quick cash or your personal info to sell.

A spokesperson for Citizens Property Insurance Corporation in Florida told us that this is not them. In fact, they don’t give quotes directly to customers without agents, especially not online.

They assured us that their fraud department is now looking into it.

But the BBB said this isn’t the first and won’t be the last site like this.

Here are some things you can do to avoid falling victim:

- Check the URL for added words or numbers

- Search the name of the business or site with words like “review” or “scam” to see what are others are saying

- Look the business up on the BBB’s actual website

- Never enter credit card information for a quote

“Spending a few minutes of your time doing that research is going to help save you being the victim of identity theft or losing money from these types of websites,” Oglesby expressed.

As for the Insurance King, he’s filed several cease and desist letters and two federal lawsuits against websites for trademark infringement. Block said two others are still pending.

“It’s very expensive, and not too many agencies like myself have trademarks, right? So I think these companies get away with it because who’s gonna stop them?” he said.

For consumers, it’s always safest to get property insurance through an insurance agent who deals directly with companies.

These business spoofers aren’t just targeting the insurance market. The BBB said they’ve had several cases in Tampa recently – one where a handyman was impersonated by someone claiming to sell baby formula online.

We asked what business owners can do if this happens to their business. Oglesby explained that there aren’t direct options for a business owner like there are for consumers who are victimized.

“You definitely want to report it to law enforcement. You want to contact the Federal Trade Commission, report it with them. IC three.gov as well. Definitely connect with your local Better Business Bureau will help you find resources and ways to combat this and also connect with your web host company and report this, that you did not authorize this to see if you can get that website shut down,” Oglesby said.

The BBB is also urging more law enforcement action against online scams.

“Prosecuting scammers remains difficult, but in March, the U.S. Department of Justice extradited and arrested two men from Lithuania for their alleged roles in a $3.5 million online vehicle sale scam. BBB urges more law enforcement action against online scams and additional protection for consumers using cash-sharing apps,” the website reads.

As a business owner, you can find information from the BBB on scams here.

Anyone can look up scams or report a suspected scam to the BBB at the Scam Tracker page here.