Reinsurance renewals saw lower Jan. 1 average rates as potential impacts from specialty lines, including aviation and the Francis Scott Key Bridge disaster in Baltimore were among trends favoring buyers, according to reinsurance brokers, as reported by BestWire.

The big picture: The reinsurance market is entering a new phase, marked by a healthy supply of deployable capacity leading to reduced risk-adjusted rates for the first time this decade, AM Best’s report noted.

- This shift, coupled with the developing cyber market’s increasing access to alternative forms of capital, suggests a changing landscape for reinsurers and insurers alike.

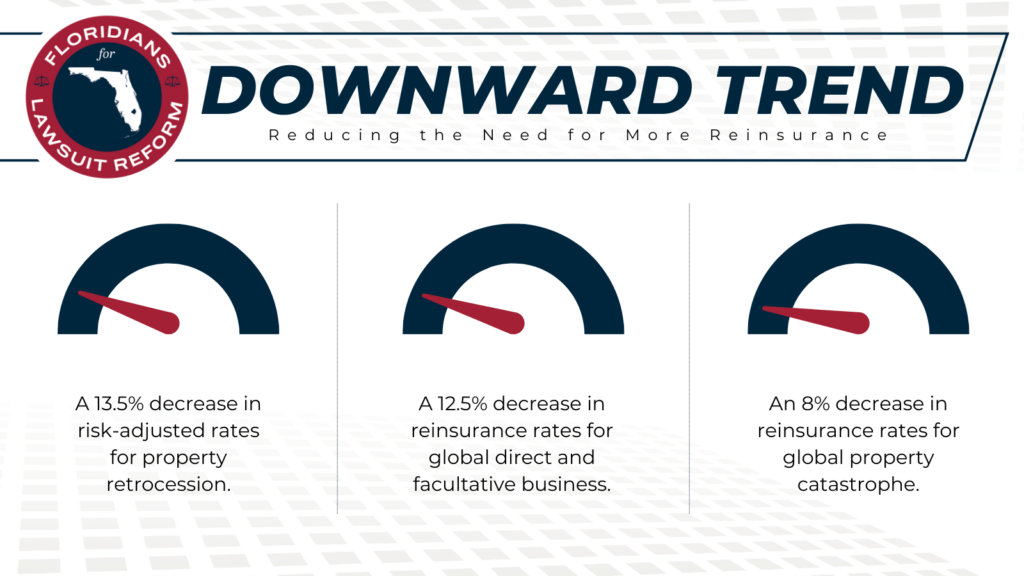

By the numbers:

- 13.5% decrease in risk-adjusted rates for property retrocession.

- 12.5% decrease in reinsurance rates for global direct and facultative business.

- 8% decrease in reinsurance rates for global property catastrophe.

What they’re saying: “Underpinning reinsurance renewal discussions, the nonlife primary insurance market has enjoyed the results of several years of improved pricing in the property, casualty and specialty areas,” said Tom Wakefield, chief executive officer, Gallagher Re.

- “After a prolonged period of rate increases across the reinsurance sector fed by accumulating and intersecting crises, the amount of deployable capacity marks an important break with the recent past and heralds a new phase in the cycle,” reinsurance broker Howden Re noted in its report.

Go deeper: Read Triple-I’s overview of reinsurance.