State Farm is no longer insuring homeowners in California because of the state’s wildfires. As hurricane season kicks off, could Florida be the next state to get the insurance giant’s boot?

State Farm is no longer providing home insurance in California because of wildfire risks and increases in construction costs. In Florida, an ongoing insurance crisis rages on and the 2023 hurricane season is here. Could State Farm pull out of the Sunshine State too?

Homeowners in Florida pay more for their insurance than most of the nation, paying over $4,000 each year on average, almost three times the national average for home insurance rates. With each year and each hurricane season, the cost for homeowners insurance in Florida increases much faster than the national rate.

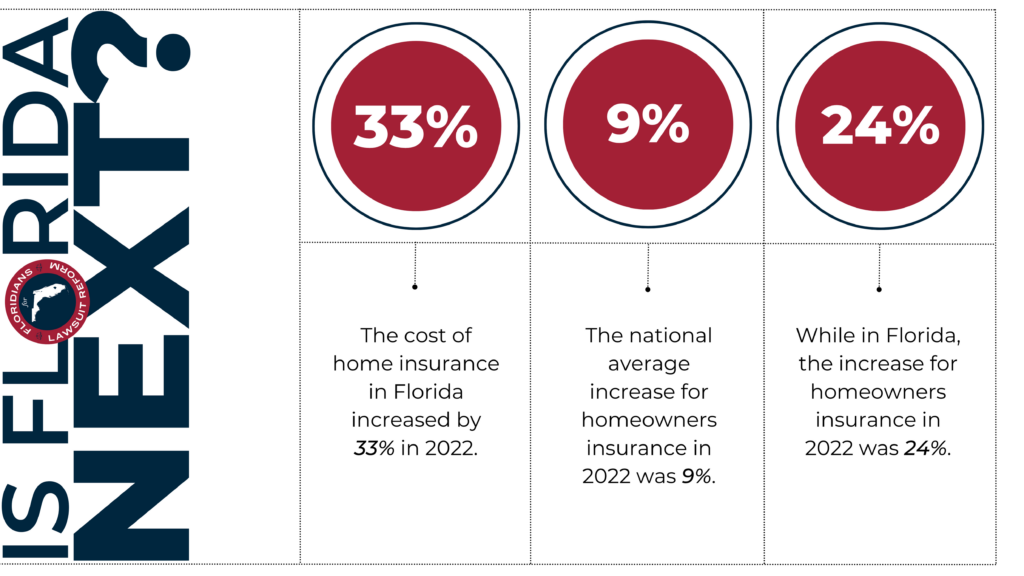

Mark Friedlander, director of corporate communications for the Insurance Information Institute (Triple-I), told USA TODAY that the average cost of home insurance increased 33% in Florida in 2022, topping the national increase of 9% by 24%.

Why would State Farm consider leaving Florida?

Florida’s home insurance market was a wreck after the National Flood Insurance Program (NFIP) paid out almost $4 billion in flood insurance payouts after Hurricane Ian last September. Florida’s struggle with spiking home insurance prices didn’t start there, though.

At the start of the 2022 hurricane season, many insurers started to scale back their policy options in the sunshine state, sparking a hike in the already-high cost for Floridians to insure their homes against damage from the state’s frequent thunderstorms and hurricanes. Some insurers left the state altogether, others went out of business. Amidst the insurer exodus, State Farm stayed put. But now that the industry giant has left California, it’s more likely that State Farm would decide to leave Florida as well.

Which insurance providers have left Florida or gone out of business?

- In June of 2022, insurance provider Southern Fidelity went bankrupt and was liquidated. As a result, around 80,000 homeowners in Florida were left without home insurance.

- Soon after, in August, Weston Property & Casualty Insurance of Coral Cables also closed its doors and canceled all policies.

- Also in August, United Insurance Holdings Corp. announced it was leaving the Florida, Texas and Louisiana markets.

- In September, FEDNat was liquidated just a few days before Hurricane Ian hit the state’s West coast.

Which insurance providers still issue policies in Florida?

Although the insurance crisis in the sunshine state seems no closer to being solved than it did last June, there are still insurance providers who insure homes in Florida.

Here are some average prices for homeowners’ insurance available to Floridians, according to an insurance guide from USA TODAY:

- Chubb – around $1,890 per year

- Progressive – around $1,340 per year

- Tower Hill – around $1,350 per year

- Universal – around $1,550 per year