UPDATED: July 28, 2024 at 6:55 a.m.

When Beryl made landfall in the Caribbean this month, it was the earliest Category 5 Atlantic hurricane on record. This has left Floridians bracing for potentially one of the most active seasons yet, with the potential for 25 named storms. Hurricanes are becoming more frequent across the state, affecting even those communities that have traditionally gone unscathed.

As a native Floridian, I know the challenges too well: long gas lines, crowded highways during evacuations, empty grocery shelves and anxious neighborhood forums asking, “Are we prepared?” The real question is not if a storm will hit, but when.

Taking steps now to protect your loved ones and your financial assets, such as your home, is crucial. What you invest today will make future disasters more bearable.

Recent events in South Florida show that hurricane-force winds are not necessary to cause significant damage. Flooding, tornadoes and tropical storms can all wreak havoc on your property, leading to expensive and lengthy repairs.

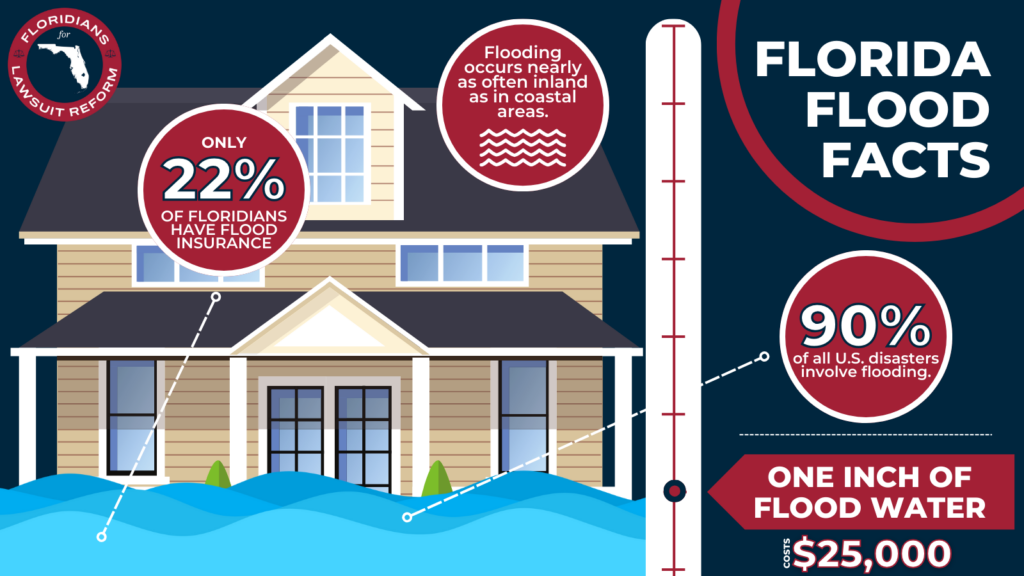

Insurance plays a vital role in recovery. Just one inch of water can cause up to $25,000 in damage to your home. Consider these facts:

- 90% of all U.S. disasters involve flooding.

- 99% of counties in the U.S. have experienced a flood.

- Only 27% of American homeowners have flood insurance, despite it being the most common and costly disaster.

- Based on recent data from Pew Research, the nation has averaged about 300 days of flooding yearly since 2000 — and not just along our coasts — with flooding reported almost as often inland compared to coastal areas from the past 20 years of hurricane data.

Standard homeowners’ insurance does not cover flood damage. Comprehensive coverage, including flood insurance, is essential in hurricane-prone areas. Although adding this expense can be challenging, the cost of repairing a home post-disaster is often much higher.

Personal preparedness can be daunting, particularly for the more than 3.5 million low-to-moderate-income households across the state.

Luckily, there are options, like reduced insurance rates through the National Flood Insurance Program for those who qualify and flexible payment plans offered by some insurers to make premiums more manageable. Homeowners can also set aside a smaller amount of funds monthly to create an emergency safety net to provide a financial buffer when disaster strikes.

As an emergency manager who has witnessed the challenges for individuals and communities recovering from storms, I believe advocating for disaster recovery reform is a priority.

We need quicker assistance to help affected disaster survivors return to safe, habitable homes more quickly. But federal disaster assistance should be a safety net, not the primary recovery source. Insured communities recover faster, reducing long-term economic impacts.

FEMA Individual Assistance covers only a fraction of repair costs and can take weeks or months to process. Long-term recovery funds are even more daunting. Though substantial, funding from the U.S. Housing and Urban Development’s Community Development Block Grant — Disaster Recovery (CDBG-DR) program is not guaranteed and does not reach affected individuals for years, significantly delaying recovery for low- and moderate-income households.

Insurance provides peace of mind and quicker access to funds for rebuilding. While insurance will not stop a storm, it will ease a significant financial burden — safeguarding assets, facilitating quicker restoration, and supporting individual and community economic stability.

As Florida’s former emergency management director, I witnessed first-hand what happens to unprepared communities. That’s why, for decades, my company has emphasized not just repairing or replacing homes but rebuilding them stronger and more resiliently than before.

This means focusing on more durable roofing and window/door systems that keep homes safer during the next storm. In fact, 94% of our repaired homes suffered minimal or no damage in subsequent storms, with over two-thirds experiencing no damage. As you improve and prepare your home for this hurricane season, it is important to consider what mitigation measures you can implement to make your home more resilient.

Resilience must start now. By preparing today, we can confidently face future disasters and ensure our communities remain strong and recover swiftly.

Bryan Koon is the former director of the Florida Division of Emergency Management. He is president and CEO of IEM, a Morrisville, N.C.-based company with offices in Tallahassee, leading efforts in emergency management, disaster recovery and resilience. This opinion piece was originally published by the Orlando Sentinel and distributed by The Invading Sea website (www.theinvadingsea.com). The site posts news and commentary on climate change and other environmental issues affecting Florida.