Posted: Feb 16, 2023 / 12:55 PM EST

Updated: Feb 17, 2023 / 01:48 PM EST

TAMPA, Fla. (WFLA) — The Sunshine State, home to more than 22 million people, has an affordability problem when it comes to housing—not just for buying a home or finding a place to rent. Protecting your home can also be expensive.

John Rollins, a former chief financial officer and chief risk officer for several Florida property insurers, as well as a former Chief Risk Officer at Citizens Property Insurance spoke with WFLA.com about the state’s ongoing property insurance issues. He served on the Citizens board from 2011 to 2013, appointed by former Gov. Rick Scott.

Rollins currently serves as a Director of Ventures at EIG Holdings, Inc., a Texas-based diversified claims, technology and restoration company serving several Florida insurers.

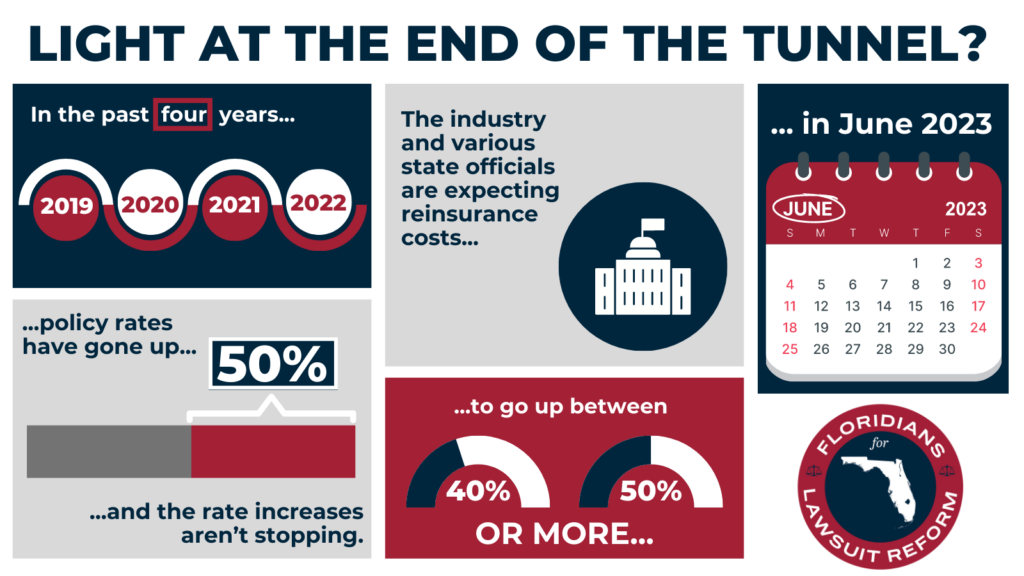

Speaking with WFLA.com, Rollins said in the past four years, policy rates have gone up 50% for Floridians, and the rate increases aren’t stopping. He said the industry, as well as various state officials, are expecting reinsurance costs to go up between 40% to 50% or more in June.

He said while complicated, the issues facing Florida homeowners boil down to how insurance policies are billed, and what’s impacting the increasing rates. As previously reported, a finding a solution to the property insurance crisis is challenging, and it’s unclear exactly what can be done to fix it in the short term.

Despite two special sessions of the Florida Legislature to find fixes for the coverage crisis, the state’s property insurance market is still presenting a struggle for homeowners, particularly after recent hurricanes battered counties in September and November.

Florida is close to unique in its disaster status, due to hurricanes. Historical data from the National Oceanic and Atmospheric Administration shows that out of all states in the U.S., Florida is hit by the most hurricanes.

None of the legislation passed in the special sessions on property insurance directly address the rates paid by Floridians. Instead, the legislation focused on making the insurance business climate in Florida more attractive to companies and reform property insurance litigation to cut costs for consumers.

As more property insurers have left the state’s market, the state’s so-called insurer of last resort has seen a growth in its policy volume, filling that gap. Citizens Property Insurance now covers 1,177,027 policies as of Feb. 10. On Jan. 9, it was 1,145,178 policies, which was nearly double the volume at the end of 2021.

By the state’s own reckoning, Florida is the state with the most private flood insurance in the U.S. In 2021, the state’s Office of Insurance Regulation reported 16.26% of all private flood premiums were in Florida. Similarly, the total direct premium written” had increased 85% since 2012, according to OIR’s report. Florida was also ranked third for premiums paid on property and casualty insurance, according to the National Association of Insurance Commissioners.

“Homeowners insurance is not required by law,” Rollins said. “Only as a condition of mortgages. So if a trend toward all-cash purchases takes hold, it is possible that the overall number of homeowners policies and premium volume in Florida could be affected downward.”

He said about 85% of Floridians with mortgages are billed for their coverage through escrow, or directly included in their mortgage payments.

In recent years, especially during the pandemic, the amount of homes purchased “in cash” or outright rather than via a mortgage or home loan, increased. While it’s now slowing down and more residents are applying for mortgages both in Florida and the U.S., Rollins said it’s possible that could have an impact on policy premiums.

Zeroing in on why, though, is difficult. There are multiple reasons rates go up, from more claims being filed to litigation over damages to who actually has property or homeowners insurance in the first place, due to what Rollins called “concentration” of coverage.

The places you live in Florida can have an impact on the overall insurance market when viewed in conjunction with how a homeowner has purchased their house. Florida, and every other state in the U.S., does not require homeowner’s insurance if you don’t have a mortgage for your home. One factor impacting rates is reinsurance, which Rollins said was “insurance for insurance companies.”

Reinsurance is “the largest expense for most homeowners insurance companies,” according to Rollins. This plays into how premiums are paid, depending on where you live in Florida.

For example, Rollins said that “if a large part of the Villages suddenly went bare,” meaning homes were bought outright and therefore did not have a homeowners insurance policy, “the overall pool of risk would face relatively (to each dollar of premium that is collected) higher reinsurance costs, because more policies would be coastal.”

He added that “if a large part of Tampa Bay did the same, the reinsurance costs might improve, because the policies more exposed to catastrophes are the ones leaving the system.”

For “catastrophe events where many policyholders have claims at once,” such as Hurricane Ian, which battered Florida in September 2022, or 2018’s Hurricane Michael, reinsurance costs make up a significant part of premium calculations.

“At the trough in 2018, reinsurance costs were around 30% of premium, but several years of abrupt hikes after stormy years have pushed it closer to 50% now,” Rollins told WFLA.com. “What is interesting is that removing a part of the policy population may increase or decrease their reinsurance cost structures, depending on where the trend of ‘going bare’ is concentrated.”

Homeowners end up paying the difference. A Tampa Bay teacher saw her premium increase from less than $4,000 to almost $7,000 in December. Her insurer, Security First, said it was due to a combination of factors, including the cost of reinsurance, litigation, and fraud, as well as an increased cost to building materials across Florida.

Rollins also said another factor in premium increases are costs to the companies themselves.

He said another “large expense for insurance companies is ‘acquisition and operating expenses,’ meaning what they pay agents in commissions and pay vendors and employees to run their operations.”

Those costs can sometimes be as much as 15% to 20% of what an insurer spends on operations. While some “costs are fixed over the short term, such as rent, IT, certain vendor contracts, and so on. So, if the overall premium pool decreases as homeowners go bare, but fixed costs don’t adjust immediately, it’s possible that a higher expense ratio could be spread over the remaining population, which would result in marginally higher rates.”

The costs for paying insurance agents, however, are typically about 10% of a premium, according to Rollins.

Policy concentration of a different nature is also impacting Floridians. Multiple property insurance providers have left the Florida market or entered receivership, where the OIR takes control and moves or backs up policies and claims to make sure coverage is continued. It’s meant the residents are footing the bills, and surcharges have already been added to monthly premiums as a result.

On Aug. 19, 2022, the OIR ordered a levy to help recoup losses. Demotech, an insurance ratings company also planned to either downgrade nearly 20 insurers in Florida, though the state acted to prevent it, at least temporarily. However, it hasn’t stopped companies from leaving.

“OIR’s greatest priority is ensuring consumers have access to insurance, especially during hurricane season; and because of the uncertainty with the status of Demotech’s ratings, we’ve been forced to take extraordinary steps to protect millions of consumers,” former Insurance Commissioner David Altmaier said in July.

Altmaier resigned from office in December. Gov. Ron DeSantis has appointed Michael Yaworsky to replace Altmaier on Monday.

Kin, a home insurance company, said that Florida’s current issues are also affected by its frequency and risk of catastrophe.

“Because Florida has the highest risk of catastrophe of any state, Florida homeowners insurance typically costs more than the national average. And, unfortunately, climate change causes more severe hurricanes,” Kin reported in January. “This increases the chance of lots of homeowners experiencing claims all at once, forcing home insurance companies to raise rates to cover the potential claims.”

The rates themselves are costly, with Insurance.com reporting most companies are charging their Florida customers between $4,000 and $5,000 for premiums, on average, though there are exceptions.

A report on property insurance stability by the Insurance Information Institute backed up Rollins’ claims for rate increases in August, with the report saying “across hurricane-prone states, mid-year renewals showed increases from 5% to 15% for loss-free accounts to up to 40% for catastrophe-exposed, loss-hit accounts,” but that “in Florida, increases were as high as 50%.”