Posted: Feb 1, 2025 / 05:44 AM EST

Updated: Feb 1, 2025 / 07:56 AM EST

PLANT CITY, Fla. (WFLA) — Hundreds of flooded-out homeowners in Flood Zone “X” face denied insurance claims and financial ruin.

Jeff Burnett lives on what he calls, one and a half acres of paradise— a beautiful piece of property right off of the railroad tracks in Plant City.

Jeff and his wife bought the land in 2023 and put a lot of time and money into renovating it.

“We took about six to eight months gutting the entire home,” he explained. “Doing everything from drywall to installation, plumbing, electrical.”

In the process of buying the home, Burnett made sure flood zones were a part of the conversation.

“The conversation, it was, ‘you’re in Flood Zone “X,”‘ and I remember the specific percentage,” he recalled. “It was .2% of any kind of flooding.”

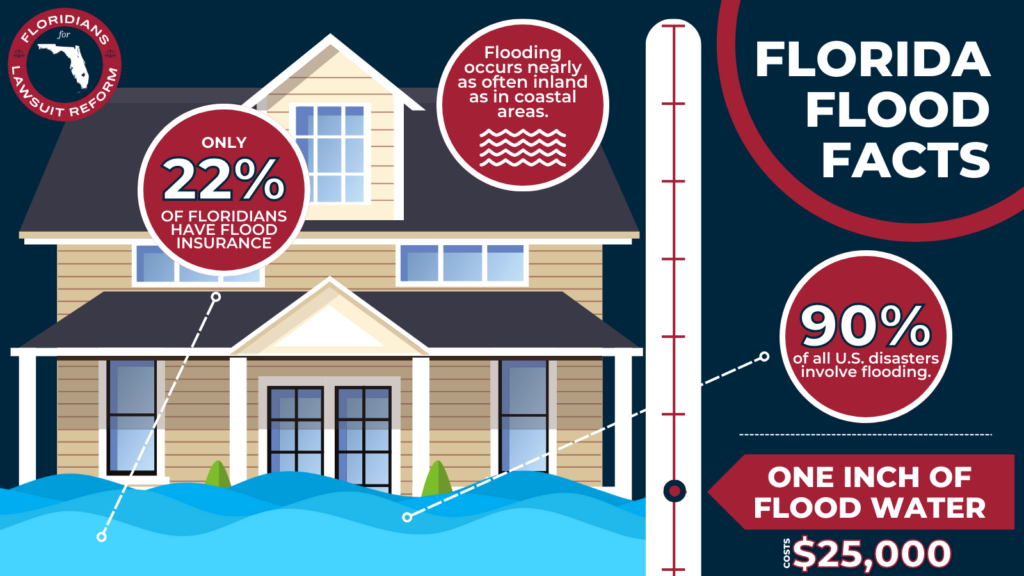

So he, like many others in the Tampa Bay area, opted out of flood insurance.

But, Burnett still got the following coverage policies: House, hurricane, other dwelling, personal property, and personal loss of use.

Bernett thought he’d be set. But then came Hurricane Milton.

“I had heard some water running which kind of made me skeptical about what was going on,” he said. “By 1, 1:30, we were in awe as the ground we’re standing on now was about 18 inches deep and just kept going.”

“We lost all of our vehicles [and] everything we replaced in the remodel,” Burnett continued. “We lost the A/C, the well pumps, the water softener systems, the electrical.”

So he went to FEMA.

Bernett got approved for a little over $1,000 for miscellaneous items like his generator rental, but as for the bulk of it, he received the following:

- November 7: Denied

- November 21: Denied

- December 20: Denied

- January 17: Denied

“At that point, it was to the point where I had submitted over 60 documents and I was just done,” he said. “What is worth the fight when I’m trying to support my wife and my family, trying to help the community, get back to work.”

“It just wasn’t worth it,” Burnett continued. “It feels like you’re just knocking on a door that you’re going to get turned away from every day.”

So, he placed his hope in his insurance, filing a claim the day after the storm

“It took us about six weeks and they came back and said, ‘We’re going to cover the roof and keep any kind of receipts, anything you have,’” Burnett said.

So Citizens gave Burnett just under $12,000 to cover his roof but told him to seek out contractors to get quotes of how much it would cost to repair his home.

That grand total came out to just under $50,000.

“We submitted all of those estimates with photos that were attached specifying the damage,” he explained. “Citizens wrote us a check for $800.”

When asked if he felt as though it were a slap in the face, he said “horrendously. Our biggest concern, being Flood Zone ‘X’, is we were told this doesn’t happen, it wouldn’t happen.”

“.2% means 99.8% of the time I should be safe, and now I’m concerned that what’s going to happen to our insurance?”, he added. “Are we going to be able to maintain our policy? Are we going to be forced to carry flood? We’re going to get flood, but how high is that going to go?”

Burnett said he’s left with a thousand questions and no answers.

“If we get hit by a hurricane next year, is the same thing going to happen?”, he said. “I’m already in the hole [of] $30,000-$50,000 by the time I’m done this. Am I going to have to redo it next year?”

Burnett said that it’s scary seeing people rescued by boat and that residents need answers.

“If I’m going to $40,000-$50,000 to rebuild for my home, my children, my wife; we work hard for our money and we deserve to know it’s not going to happen next year,” Burnett said. “If it is going to happen, why is it happening?”

8 On Your Side went to the county for answers on why Burnett’s property flooded and received the following statement:

“Generally, high risk flood zones and floodplain areas are based on a 100-year modeled event. Hurricane Milton greatly exceeded that level and equated to a 200-500 year event, which means that additional flooding would be expected in some areas outside those zones. This area appears to be within the basin affected by the Hillsborough River, which reached the highest level ever recorded, a full 3.5 feet higher than the previous record during Irma.

Unfortunately this resulted in flooding to properties outside of high risk flood zones.”Hillsborough Countynone

A few months ago, Tampa City Council and the Hillsborough County Commission approved a joint independent investigation into Hurricane Milton’s impacts, specifically why so many areas in Flood Zone ‘X’ flooded.

The county provided the following statement as an update on the investigation:

“Immediately following Hurricane Milton the Hillsborough County Board of County Commissioners acted to initiate an independent evaluation of the regional impacts of Milton and recommend strategies to help reduce the risks to our community. The study includes interviews with elected officials, stakeholder engagement with regional partners such as the Southwest Florida Water Management District and our neighboring cities and counties, and a public outreach campaign to gather information from residents affected by the flooding. This independent evaluation is underway, with the public engagement planned to begin in March, and the report to be completed and delivered to the Board of County Commissioners in June.”Hillsborough County

none

County officials said to click here for more information on flood safety, risk and insurance.