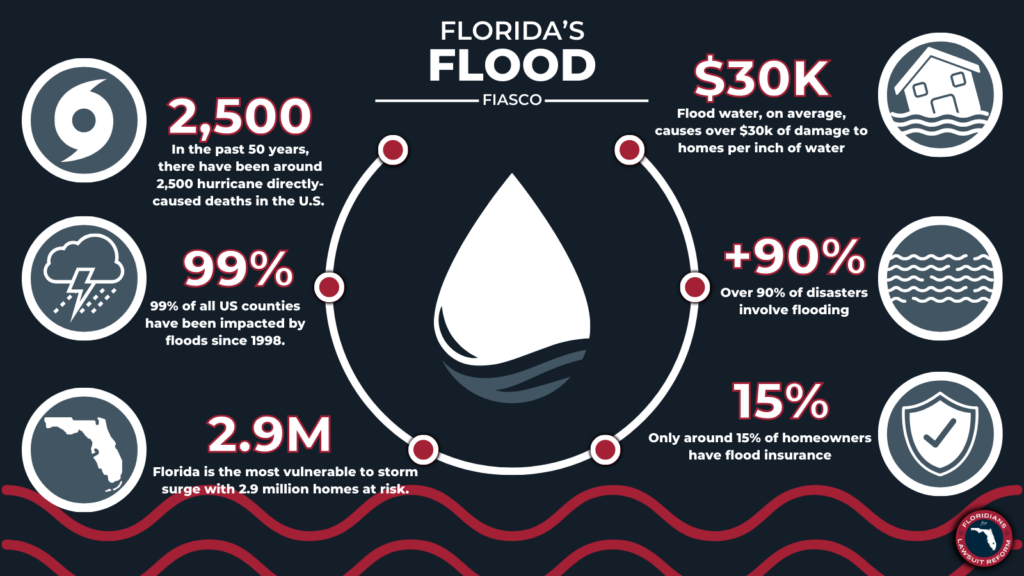

South Florida has seen historic flooding in 2023. Yet, according to the Insurance Information Institute, only about 10-20% of property owners in South Florida have a flood insurance policy.

NBC6 spoke with Mark Friedlander of the Insurance Information Institute to answer some questions you may have about flood insurance.

Do I really need flood insurance if I already have a homeowner’s insurance policy?

Your regular homeowner’s insurance policy will not cover damage caused by rising water (i.e. flooding), even if it happens during a hurricane. Just look at what happened with Hurricane Ian in 2022. A lot of property owners suffered both windstorm and flood damage – many did not have flood coverage, leaving them with gaps in their coverage.

I don’t live in a FEMA-designated flood zone, so I don’t need flood insurance, right?

While it’s not required, flooding can happen anywhere, anytime.

“As we continue to see in South Florida, severe flooding events happen year-round, not just hurricanes, not just tropical storms,” Friedlander said. “Look at king tides, which could be clear, sunny days and we see street flooding.”

Still, Friedlander said the Institute is seeing a declining trend in the number of property owners who buy policies. A big reason for that is rising premiums. We’re already paying thousands of dollars for homeowner’s insurance, so even if a flood insurance policy is a few hundred dollars more, some people just can’t afford it. If they don’t live in a flood zone and their mortgage company doesn’t require that they have flood insurance, they may opt to skip it altogether.

Why is flood insurance getting more expensive?

A majority of people (around 80%) who have this coverage, have it through the National Flood Insurance program, which had some changes that are impacting premiums, Friedlander said.

“NFIP has implemented this new rating program called Risk Rating 2.0,” he explained. “And in some cases, it’s very expensive and it’s far above the rate private insurers are offering. If you’re looking for flood insurance or you want to quote your current coverage, we recommend getting a few quotes from the private market as well because you might find better coverage for a better price,”

If I have damage and I have insurance, what should I do if I need to file a claim?

Call your agent as soon as possible to report the damage and open a claim. Make sure you document the damage, take pictures and video showing where the water reached and the extent of the damage. You may be able to send those pictures to your agent or directly to the insurance company to help expedite your claim.

My car was flooded out. Do I have coverage?

Depends. If you have comprehensive coverage, flood damage is covered.

“It’s optional coverage on auto policies,” Friedlander said. “About 80% of Florida drivers carry it and it covers all non-collision damage including theft, vandalism and storm damage.”

If you don’t have comprehensive coverage, flood damage is not covered.