Aon has estimated that losses from the recent flood event in South Florida could run “hundreds of millions” of dollars, with several thousand residential and commercial properties and vehicles sustaining damage from the deluge that lasted several days during the week of June 9, according to BestWire.

By the numbers:

- 20 inches of rain was measured in parts of Miami-Dade and Broward counties during a series of storms fueled by a low pressure system in the Gulf of Mexico. Areas of Florida’s Gulf Coast also sustained flood damage from the storms, including Marco Island, Naples and Sarasota.

- Approximately 1,300 comprehensive auto claims were reported by State Farm as of June 20. State Farm is the third-largest writer of personal auto p0licies in Florida.

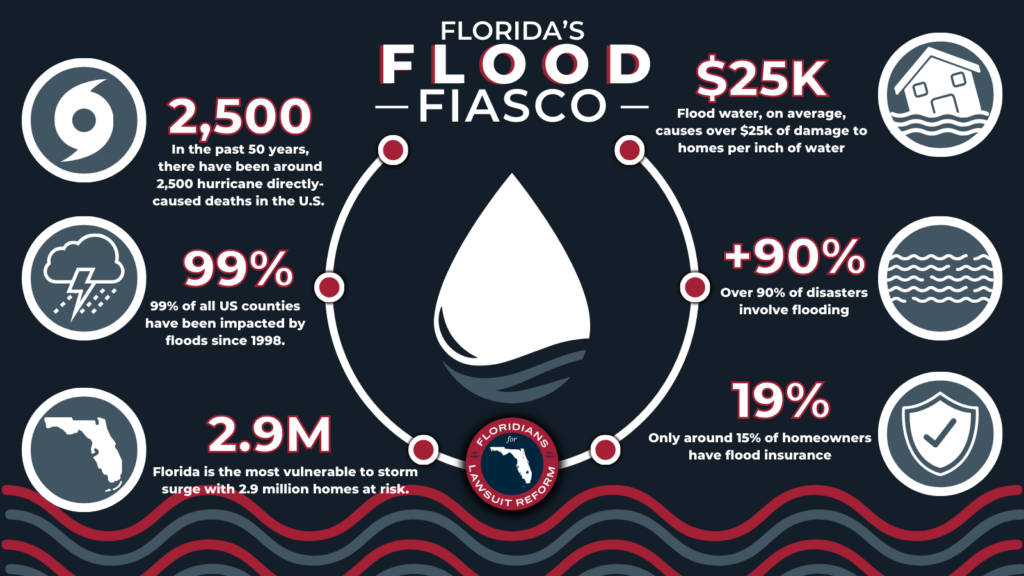

- 19% of Florida homeowners have flood insurance, the largest percentage in the U.S. Nearly half of National Flood Insurance Program policies are written in Florida.

What we’re saying: “What we experienced is a stark reminder that flooding can occur any time in South Florida, not just during hurricanes,” Triple-I’s Mark Friedlander told the South Florida Sun Sentinel.

- He added, “Flooding is not restricted to FEMA flood zones. It can occur in any community. Homeowners need to own their risk and assess how vulnerable they are to hazards like flooding. You are not fully protected from storm hazards without flood insurance.”

Yes, but: While the losses are substantial, the flooding across South Florida may not trigger a federal disaster recognition, according to local and state officials. This could potentially limit the financial aid available to the affected areas and storm victims who were not insured.