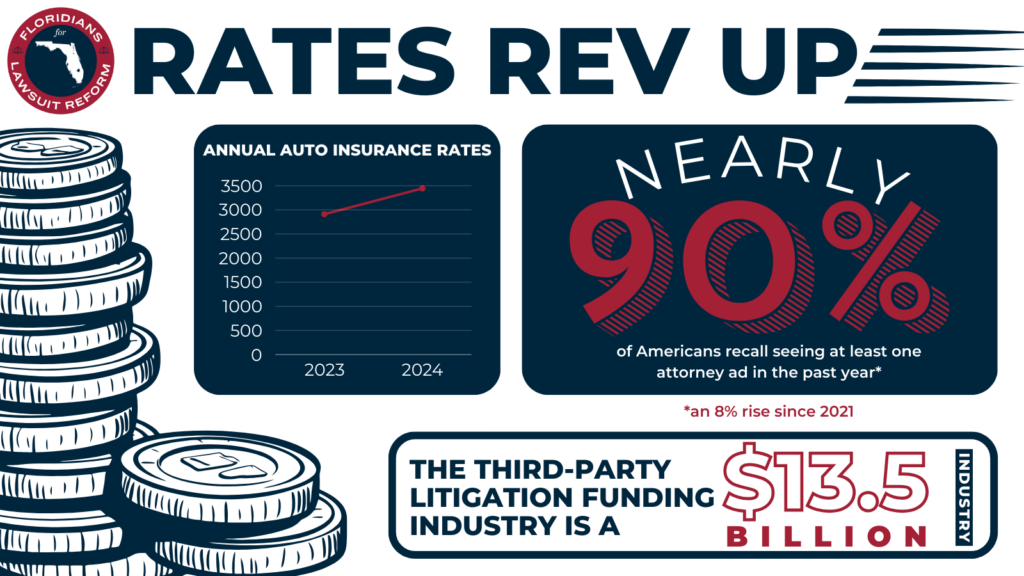

Florida drivers are projected to face an 18% increase in auto insurance premiums by the end of 2024, according to a recent Insurify report. The average annual cost of full coverage is expected to rise from $2,910 in December 2023 to $3,444, with third-party litigation funding (TPLF) and increased attorney advertising driving up insurance costs statewide.

Attorney advertising has become a significant factor in rising premiums. An October 25 report by the Insurance Research Council (IRC) found that 60% of respondents believe attorney advertising raises the number of auto claims, up from 55% in 2021. Additionally, 52% think this advertising increases their insurance costs, compared to 45% in the previous survey.

“Most respondents believe that attorney advertising increases auto insurance costs by encouraging more legal involvement, which leads to higher claim settlements and legal expenses,” said Dale Porfilio, President of the Insurance Research Council.

The IRC report also highlighted the widespread nature of attorney advertising, with 89% of Americans recalling attorney ads in the past year—an 8% rise since 2021. Among those who recently filed auto claims, 62% observed more attorney ads, compared to 42% of those who had not filed claims. Advertisements primarily focus on auto accident injuries, cited by 63% of respondents.

Along with attorney advertising, TPLF is adding to policyholder costs. By investing in lawsuits for a share of settlements, TPLF contributes to extended legal processes and larger settlement amounts, which insurers then pass on to policyholders through higher premiums.

As Florida premiums are expected to average $3,444 by the end of 2024, industry experts and consumer advocates are pushing for regulatory reforms to address the impact of TPLF and attorney advertising. In response, the Florida Senate has advanced legislation to regulate the $13.5 billion TPLF industry, reflecting concerns over its influence on insurance costs.