Residential property insurers operating in Florida are approaching $1 billion in net income losses through the first nine months of 2021.

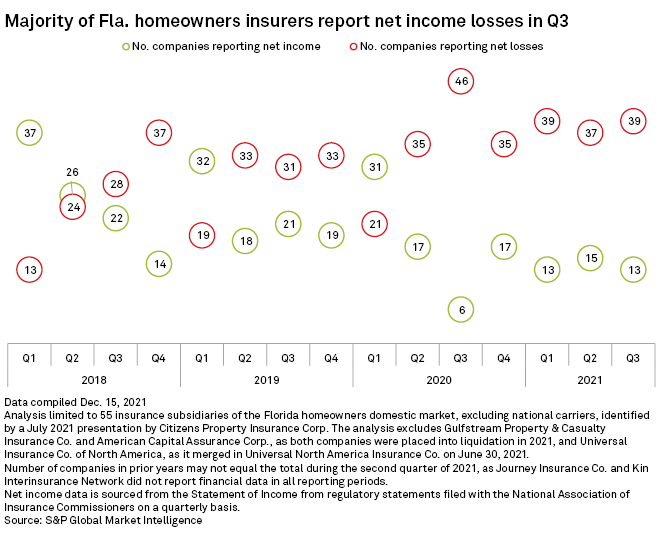

Of the 52 individual insurance subsidiaries identified by Citizens Property Insurance Corp. operating in the Florida homeowners insurance market, 39 reported net income losses in the third quarter, according to regulatory statements. In aggregate, those companies lost $417.5 million in the period.

Collectively, the group recorded total losses of $542.6 million during the first half of the year, after adding $13.2 million in losses, Vault Reciprocal Exchange reported in late-filed quarterly statements.

Citizens President and CEO Barry Gilway, during a Dec. 15 board of governors meeting, characterized the Florida homeowners market as “disturbing,” saying the private market through the third quarter had already exceeded the negative net income it accumulated during all of 2020. Negative net income for the market came in at $816 million for 2020.

“Virtually all” companies operating in Florida are reducing their footprints, Gilway said, and many are nonrenewing business that would have been considered “highly profitable” as recently as a year ago.

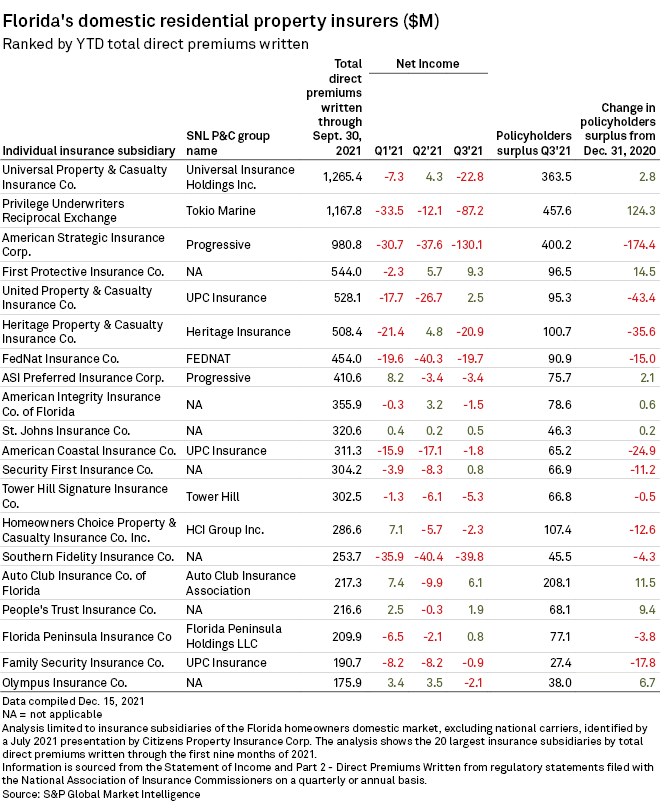

The Progressive Corp. subsidiary American Strategic Insurance Corp.’s third-quarter net income loss of $130.1 million was the largest reported loss within the group of companies in this analysis. Roughly 13% of the company’s year-to-date direct premiums written have come from the Sunshine State.

Progressive subsidiaries have seen rapid growth in the Florida market and other catastrophe-prone states; the company is now taking steps to reduce its exposure within states it deems to be more volatile.

Four other subsidiaries among the largest Florida homeowners insurers recorded third-quarter net losses of more than $20 million. Privilege Underwriters Reciprocal Exchange had a net loss of $87.2 million, Southern Fidelity Insurance Co. Inc. logged a net loss of $39.8 million, Universal Property & Casualty Insurance Co. had a $22.8 million net loss, and Heritage Property & Casualty Co. posted a net loss of $20.9 million.

Citizens policies’ jumps

Those losses numbers in the private market have translated into another surge in business for Citizens in Florida. The insurer of last resort has budgeted for 1.06 million policies-in-force for 2022, a 37.4% increase from a projected 775,431 in 2021. The budget calls for 2022 written premiums to increase 64.8% to just over $3.0 billion from the 2021 total of $1.82 billion.

Gilway said the sharp rise in in-force policies for Citizens is due to other companies “losing their shirt” in the Florida market.

“They can’t survive with the amount of business that they have,” Gilway said.