By Ron Hurtibise

The state’s “insurer of last resort” has a growing number of policies because it’s the cheapest option. Since 2021, 3 insurers’ rates have gone up over 40%, 1 over 60%.

FORT LAUDERDALE, Fla. – Yes, there are some trade-offs to being insured by state-owned Citizens Property Insurance Corp.

But despite them, there’s little argument that folks who rely on “the insurer of last resort” have been facing insurance rate hikes that rank among the lowest over the past two years.

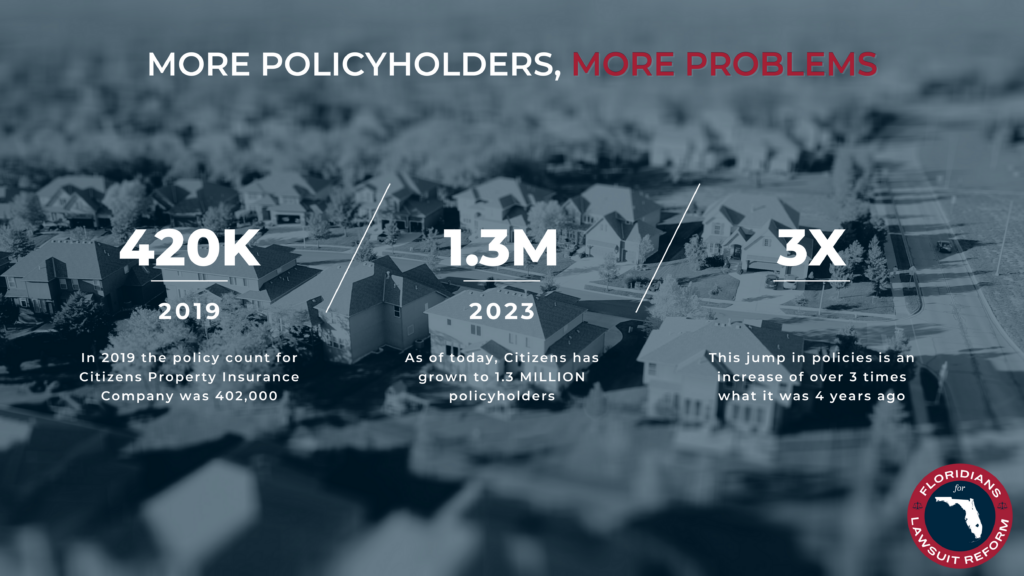

It’s one reason, along with a growing reluctance by private-market insurers to continue insuring Florida homes, why the number of accounts covered by Citizens’ has grown from 420,000 to 1.3 million since 2019.

And if you can manage to keep Citizens as your insurer, many would point out that you are in better shape than neighbors who are stuck paying rates with larger year-over-year increases.

A South Florida Sun Sentinel comparison of top 10 insurers found that Citizens imposed rate increases that were among the lowest. The newspaper dug deep into rate hike requests stored by the Florida Office of Insurance Regulation (OIR) and added up the increases approved since mid-2021, as well as hikes recently requested but not yet approved.

Companies with the highest total rate increases were:

- Universal Property & Casualty (40.8%)

- State Farm Florida (28.1%)

- ASI Preferred (61.5%)

- Castle Key Indemnity (45.5%)

- Heritage Property & Casualty (34%)

- Security First Insurance Co. (43.7%)

Only United Services Automobile Association (16%) and First Protective Insurance Co. (21.8%) had lower totals over the past two years. Data was unclear for another company in the top 10, American Integrity Insurance Co.

Locke Burt, president and CEO of Security First, said the 43.7% increase tallied by his company seemed “pretty low.” That’s because the increases are compounded over time and become higher as home values swell, he said.

“When you look at the impact on pocketbooks, the 43.7% is understated,” Burt said. “There’s no doubt that the price of homeowner insurance has gone up significantly over the past two years and is going up further.”

So in such an environment, wouldn’t it make sense to latch onto the lowest-priced insurer for as long as you can?

One reason Citizens can offer such low prices is that the company needn’t rely on the actual cost of providing insurance when setting rates. With no shareholders or owners, Citizens derives much of its value from how its $4.9 billion in surplus performs in the financial market.

Yet, lawmakers and Citizens’ governing board members have been growing concerned about the potential impact of Citizens’ low rates on the health of the private insurance market and on insurance customers across the state. As Citizens grows larger, it becomes more vulnerable to one or more massive storms wiping out its reserve and triggering mandatory assessments until any deficit is paid. The first assessment – of up to 45% of Citizens’ premiums – would be borne by Citizens’ own customers.

If that amount doesn’t wipe out the deficit, Citizens is allowed to charge 2% to customers of private-market homeowner policies, auto, specialty and surplus lines policies. And if that still isn’t enough, the company can then charge 10% for each of Citizens’ three accounts to both Citizens and non-Citizens policyholders for as many years as necessary until the deficit is resolved.

Part of the reason that Citizens’ rates have been so low is a 10% annual rate cap imposed by former Gov. Charlie Crist in 2009. But in a vote last year, the state Legislature OK’d a measure that would increase the cap by 1% over five years until 2026, when it would hit 15%.

Still, that doesn’t mean that state insurance regulators will go along with a maximum increase.

In 2021, Citizens’ Board of Directors asked the state to approve a 7.2% rate hike, but state insurance regulators knocked it down to 3.2%.

Last year, Citizens’ board sought a 10.8% increase, but the state brought it down to 6.4%.

This year, the company is again seeking an increase that would nudge its rates closer to its private-market competitors. If approved, owners of homesteaded single-family homes would pay 12.7% more if they renew between Nov. 1 and Dec. 31, and up to 13% after Jan. 1.

State insurance regulators can decrease it again, but Citizens spokesman Michael Peltier said in March that a new law calling for Citizens to avoid offering competitive rates should justify approval of rate hikes for most of its customers.

He noted on Friday that Citizens continues to grow despite measures to slow it down.

The company has been averaging 7,100 new policies a week since Jan. 1, he said. “That number has remained pretty consistent, so we have yet to feel the full benefits or recent reforms.”

Citizens expects that to change, as more customers face a new rule barring them from remaining with Citizens if a private company offers to take them for up to 20% more in premium than they currently pay. Previously, Citizens customers needed no reason to decline a “takeout” offer.

Also, Citizens is now allowed to increase rates charged on vacation and investment homes by 50%. The company expects that will reduce Citizens’ population as well, Peltier said.

Yet, if rates continue to increase as they have been, Citizens might always remain the cheapest insurer in Florida.

Burt, however, thinks we’ll soon see rate increases come into line with annual inflation, thanks to litigation reforms that are already slowing the rate of lawsuits against insurers.

One reform curtailed the ability of contractors to sue insurers after convincing homeowners to sign over their rights to pursue payment. Another barred attorneys from collecting legal fees whenever an insurer they sue agrees to pay more than they originally offered to settle a claim.

Another six to eight months of rate increases are coming, Burt said, thanks to another round of rate hikes by reinsurers – the global finance companies that protect insurers. But afterward, “I think there’s a better than even chance that the market has achieved stability in terms of rate,” he said.

© 2023 South Florida Sun-Sentinel. Distributed by Tribune Content Agency, LLC.