Published August 20, 2022 at 8:57 AM EDT

The Board of Directors made the decision to borrow $150 Million after five property insurers have gone insolvent in Florida since February.

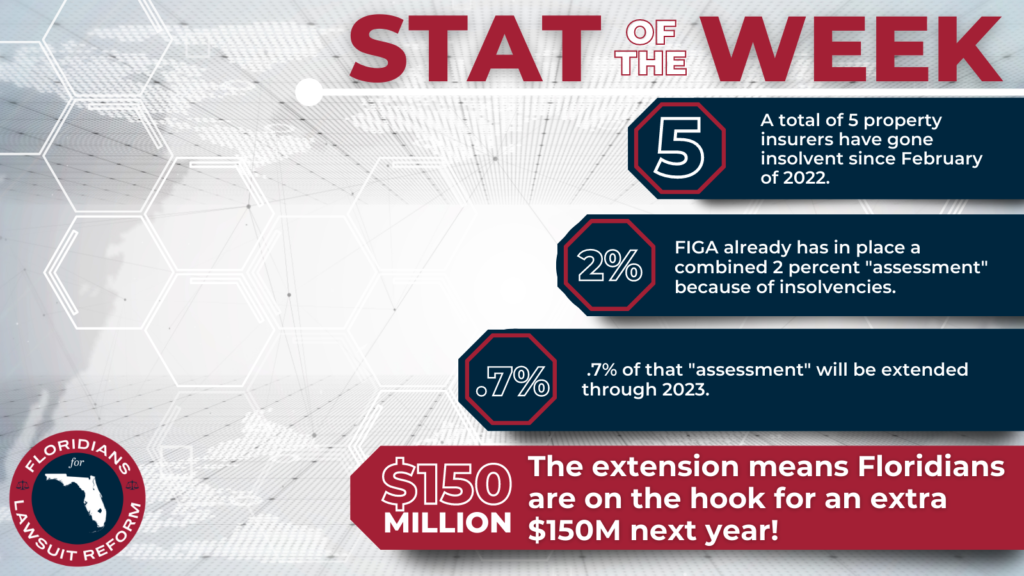

In more fallout from Florida’s troubled property-insurance market, an agency that handles claims after insurers go insolvent approved a plan Friday to borrow $150 million — with policyholders across the state slated to pay back the loan.

The Florida Insurance Guaranty Association Board of Directors made the decision after five property insurers have gone insolvent since February.

The agency, commonly known as FIGA, is a non-profit organization set up by the state to help address insurance insolvencies. It has authority to levy “assessments,” which are costs passed on to insurance policyholders.

FIGA already has in place a 1.3 percent assessment and a 0.7 percent assessment because of insolvencies. The plan approved Friday will lead to the 0.7 percent assessment being extended through 2023 to finance the loan.

“We realize this is the Florida policyholders’ money we are spending, and we don’t take that lightly,” Corey Neal, executive director of FIGA, said during Friday’s board meeting.

Neal said the loan is primarily needed to cover claims from the insolvency of Southern Fidelity Insurance Co., which was placed into receivership in June.

Other property insurers that have gone insolvent since February are Weston Property and Casualty Insurance Co.; Lighthouse Property Insurance Corp., Avatar Property & Casualty Insurance Co. and St. Johns Insurance Co.

The 1.3 percent assessment, which was approved in March, was primarily related to claims from St. Johns Insurance Co., according to the FIGA website