Susan Salisbury | Special to The Palm Beach Post

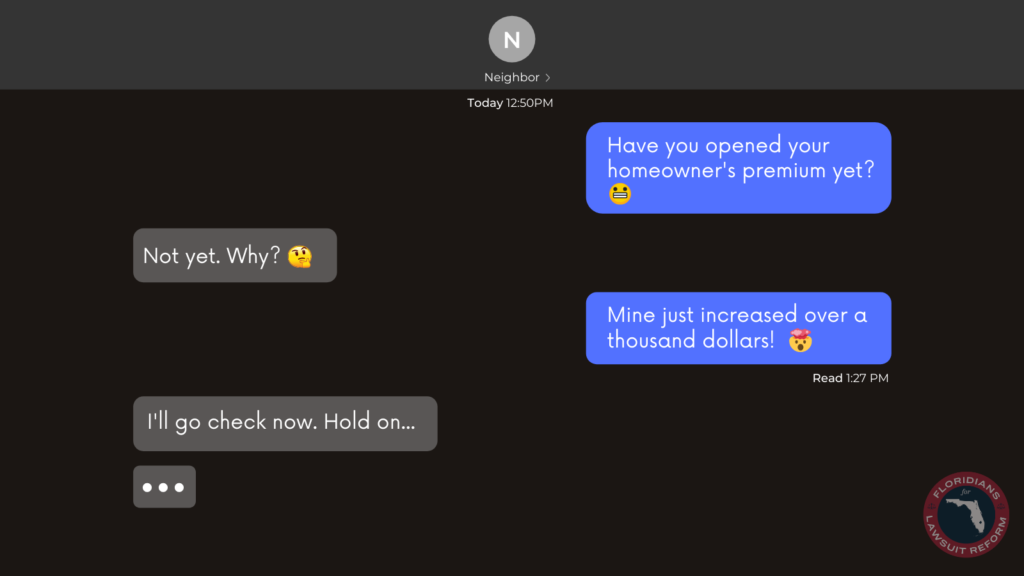

Florida homeowners are being hit with double-digit percentage insurance-rate increases, and the insurance market has reached a crisis stage. In the distressed market, some homeowners’ premiums have doubled.

“Consumers are paying higher premiums for less protection and fewer options,” said Florida Insurance Consumer Advocate Tasha Carter. She said factors such as contractor fraud and increased litigation lead to increased rates and coverage restrictions.

Carter, who said she’s been working to fix problems through legislation and initiatives, said: “As an industry, we must take decisive action to protect consumers, address the key factors impacting the insurance market and decrease rates.”

Last year the Florida Office of Insurance Regulation approved 105 homeowners insurance rate filings. Ultimately, 55 were approved for an increase greater than 10 percent, said FIOR spokeswoman Alexis Bakofsky.

Rate increases granted ranged from 12 percent to 31 percent.

“The Florida insurance market is one of the most complex in the world, and the property market is currently facing significant challenges as the frequency of claims increases and those claims become more expensive,” Bakofsky said.

He said the challenges are mostly because of increased litigation, exacerbated by higher catastrophe claim losses as a result of multiple hurricanes over the past several years, and rising reinsurance costs as a result of a hardening reinsurance market.

“These developments have presented challenges not only to the property industry, but also to Florida consumers,” he said.

Some Florida homeowners being told their policies are being dropped

In addition to huge rate increases, some Florida homeowners are receiving notices that their insurance companies are dropping their policies. So more homeowners are seeking coverage from Citizens Property Insurance Corp., the state-run insurer of last resort.

Since October 2019, Citizens’ policy count has jumped from 420,000 to 584,000. This spring, it is seeing increases of more than 5,000 new policies per week. At this pace, company officials expect the policy count to approach 750,000 by the end of 2021.

Citizens, too, is being allowed to raise its rates an average of 3.2 percent, half of the 6.2 percent increase requested. The new rates take effect Aug. 1.

The cost of insuring the insurers is forcing rates to rise also

Florida insurers say the rate increases are needed as they continue to experience underwriting losses. One major reason is the cost of reinsurance, which is basically insurance to back up insurers. They also point to claims for water damage from leaks that are not related to hurricanes.

Florida’s domestic insurance market lost $1 billion in underwriting losses during the first three quarters of 2020, Florida Insurance Commissioner David Altmaier said. The losses are twice what the industry experienced in 2019, and the losses have been going on for at least five years for most companies.

Insurance companies lay part of the blame on hurricane damage claims for losses from Hurricane Irma in 2017 and Hurricane Michael in 2018.

Insurers are still processing claims from Irma and Michael. The Office of Insurance Regulation reports 158,991 claims totaling $9.1 billion in insured losses from Michael, and 1.1 million claims totaling $20.6 billion in insured losses from Irma.

Just over 57,000 claims filed from Palm Beach County related to Irma

None of the claims for Michael were from Palm Beach County. However, 5 percent of the claims related to Irma, or 57,065, were from the county.

Of course, Irma and Michael followed Hurricane Matthew in 2016 with 119,345 claims, including 1,675 from Palm Beach County. Insured losses from Matthew totaled $1.82 billion.

Another major hurricane that damages Florida will obviously only worsen the situation.

Rising insurance rates are caused in large part by unnecessary lawsuits filed against insurance companies by unscrupulous contractors. After a storm, some contractors knock on homeowners’ doors, telling them they might have damage and should file a claim.

In 2019, the latest year available, Florida homeowners accounted for 76 percent of lawsuits against insurance companies, according to the FOIR. That same year, Floridians accounted for only 8 percent of claims filed.

Florida’s had over 60% of the nation’s property insurance suits since 2016

Altmaier, who used data from the National Association of Insurance Commissioners, said Floridians have been responsible for more than 60% of property insurance litigation nationwide since at least 2016.

Florida consumers are paying a “hidden tax” to fund the litigation that averaged about $680 per family in 2020.

Barry Gilway, Citizens president/CEO and executive director, applauded the state Legislature’s April 30 passage of SB 76, legislation which addresses the problem of rising insurance rates due to unnecessary litigation.

The bill now goes to Florida Gov. Ron DeSantis for his approval. If he signs it, it will take effect July 1.

“Citizens is growing at an unsustainable rate, putting our customers and Floridians on the financial hook when a big storm hits the state,” Gilway said.

The action is an encouraging sign that the Florida Legislature understands the severity of the situation and is willing to take meaningful steps forward, especially as it relates to litigation, Gilway said.

Bill that awaits governor’s signing could affect whole insurance industry

The bill makes several changes that affect the entire industry, including an attorney fee structure based upon the difference between the initial offer and the final payment. The bill also prohibits public adjusters, contractors, or their representatives from offering financial incentives to policyholders for roofing inspection and repairs.

For Citizens, the bill raises the current 10% cap on annual premium increases by 1 percent per year over the next five years. The phased-in expansion of the glide path to 15 percent will allow Citizens to make its rates more competitive with private insurance coverage.

The bill would steer potential Citizens’ policyholders to private insurance carriers if a private policy premium were within 20 percent of the comparable Citizens policy premium. The bill would also require Citizens to factor into its rates the reinsurance costs necessary to protect its surplus from a 1-in-100-year storm.

Other types of insurance fraud are also on the rise

Fraud due to the assignment of benefits, where a policyholder signs over benefits to a contractor, is also on the rise.

Michael Carlson, president and CEO of the Personal Insurance Federation of Florida, an industry group, said, “The litigation environment, driven by Florida’s “one way” attorney fee law (627.428) is absolutely terrible. There is a strong financial incentive for lawyers to litigate even minor disputes over property insurance claims. This directly increases costs – costs of litigation are passed through to consumers in rates.

He said SB 76 has some good provisions, such as a reform to the attorney fee law that could help lower costs. But, he said, the bill lacks some other provisions that were included in earlier versions, such as the limit on the use of the attorney contingency fee multiplier and a limit on roofing costs.

“I think that overall, the bill will have a positive effect on the market, but it is not a ‘moonshot’ solution that will quickly resolve the crisis,” Carlson said. “Chances are that conditions in the market will improve by a modest amount.

“We will still be working on this issue for the time being, because while we try and make reforms that will lower costs and lower rates, trial lawyers and vendors are trying to increase profits,” Carlson said.

Tips from the OIR

The Florida Office of Insurance Regulation provides a list of the largest insurance companies doing business in the state with contact and claims information for each at:

https://www.floir.com/siteDocuments/FLLargestPropertyCompaniesContact09182017.pdf

The FIOR also provides a home inventory list, handy for getting a good idea of what you have to lose. Share it with your insurance agent and store it in a safe, waterproof place, ideally away from your home.

https://www.floir.com/siteDocuments/InventoryChecklist_6-26-08.pdf