Some Florida homeowners are choosing to “go naked” by dropping their property insurance and opting to self-insure instead.

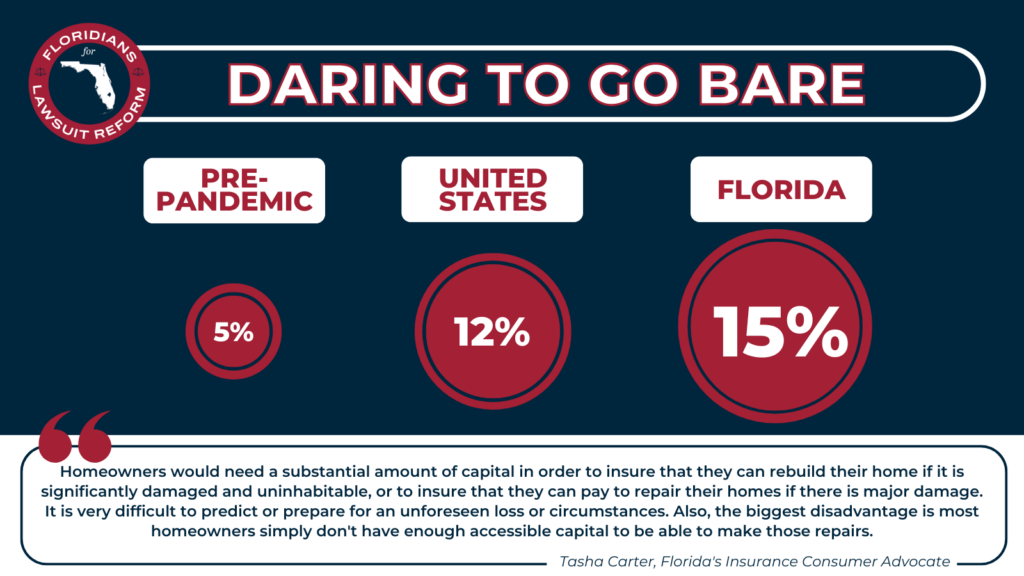

“We did a national survey last year that showed 12% of U.S. homeowners are currently self-insuring. That’s a large spike from pre-pandemic, which was about 5%. So we’re seeing an uptick across the country, including Florida,” Insurance Information Institute’s Florida spokesman Mark Friedlander said. “Florida typically runs higher than the national average. We’re estimating about 15% of Florida homeowners are self-insuring right now.”

Self-insuring means a homeowner has decided to forego traditional insurance policies, and instead, they save the money in an investment or savings account in case they need it.

Usually, the only people who can self-insure are people who own their own home outright, says Florida’s Insurance consumer advocate, Tasha Carter.

“Typically, if you have a mortgage loan, as a part of that contract, it’s going to require that you maintain insurance coverage on the home,” Carter said.

Experts say home insurance has gotten more expensive, which has caused people to look at self-insuring.

“Across the state, we’ve been experiencing a homeowner’s insurance crisis. Homeowners have been impacted primarily as it relates to that crisis, with an increase in the cost of homeowner’s insurance policies,” Carter said.

Still, there are many risks associated with opting out of home insurance.

“Homeowners would need a substantial amount of capital in order to insure that they can rebuild their home if it is significantly damaged and uninhabitable, or to insure that they can pay to repair their homes if there is major damage,” Carter said.” It is very difficult to predict or prepare for an unforeseen loss or circumstances. Also, the biggest disadvantage is most homeowners simply don’t have enough accessible capital to be able to make those repairs.”

Friedlander also strongly recommends against self-insuring. He said, instead, people should look for ways to manage the cost of insurance.

“Bundling home and auto is one of the best ways to get a discount. Changing your deductibles [can also help]. Higher deductibles could bring down the cost of your insurance significantly,” Friedlander said. “Talk with your agent, see if there’s any steps you could take, because going without insurance is really the worst possible choice in our opinion. It’s very risky and most people live to regret it, especially in a state like Florida, with so many hazards that we face all year round.”