The state’s largest insurer defends its record of closing claims without payment at first meeting since hurricanes’ one-two punch

This story has been updated because it contained an inaccuracy.

In the first meetings of officials from Citizens Property Insurance Corp. since back-to-back hurricanes raked Florida this year, the state’s largest insureracknowledged data showing half of last year’s claims were closed without payment and how the resolution of this year’s storm claims could produce a similar result.

The percentage of claims that have been or will be closed without payment is likely to be closely watched, as this is the first season of major, multi-storm hurricane activity since the state Legislature passed reforms that make it harder to sue one’s insurer when the policyholder finds a settlement unsatisfactory. While the move advanced with the argument that tort reform was key to shoring up the state’s insurance market battered by frivolous lawsuits, others see policyholders left at the mercy of their insurance company’s decisions.

Reporting on the company’s 2023 claims shows that Citizens is closing a greater percentage of cases without making a payment than the state’s other private insurers. The state had one hurricane landfall last year — Hurricane Idalia hit the sparsely populated Big Bend region at Category 3 strength in August 2023.

A report from Weiss Ratings, a Palm Beach Gardens ratings agency, found that the state-backed insurer of last resort closed homeowner claims without a payment 50.4% of the time in 2023. That compares with 36.7% for Universal Property & Casualty Insurance Company. The percentage that other insurance companies − Castle Key Insurance, Castle Key Indemnity and State Farm Florida − closed claims without payment ranged between 46% to 47.1%.

The media coverage of that report, first from the Tampa Bay Times/Miami Herald Tallahassee bureau, stirred criticism from Citizens’ Claims Committee members and Jay Adams, Citizens’ chief insurance officer, who met Thursday, Nov. 21.

“The titles of these articles go something like, ‘Citizens Insurance had the worst rate of paying Floridians’ claims, half of the people got nothing,’ and so forth,” Adams said. “So, some of the facts are misleading in these articles.”

Company officials at Weiss Ratings said that the conclusion about Citizens’ high rate of closing claims without payment is built on data that comes from Citizens’ own reports, available on its website.

“We believe it’s important to analyze the data and it appears that Citizens does not currently understand precisely why each claim was denied for this season’s storms,” a Weiss statement read. “We would hope that Citizens would do the necessary analysis rather than focus on headlines they don’t like.”

Citizens’ officials: Higher property insurance claims closures without payment not surprising

Despite his criticism of the media coverage, Adams acknowledged there might be some truth to the data behind the Weiss report. Scott Thomas, the committee’s chairman, called the media coverage of the report “clickbait.”

“Citizens probably has the highest closed without payment rate, and I think that’s probably very factual,” Adams said.

But there are reasons for that rate of closing claims without payment, he said.

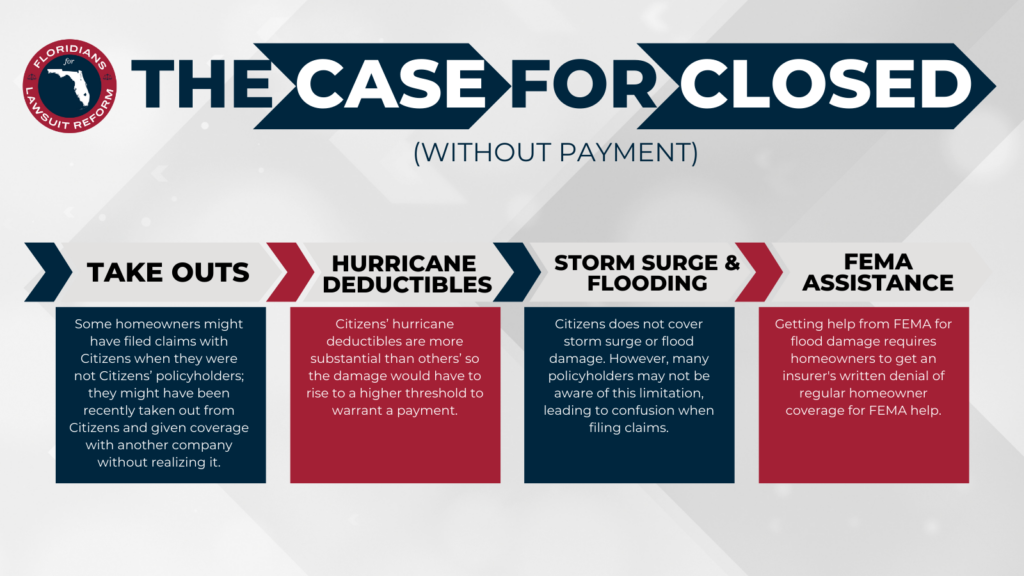

Among them:

∙ Some homeowners might have filed claims with Citizens when they were not Citizens’ policyholders; they might have been recently taken out from Citizens and given coverage with another company without realizing it.

∙ Citizens’ hurricane deductibles are more substantial than others’ so the damage would have to rise to a higher threshold to warrant a payment.

∙ Citizens does not cover storm surge and getting help from FEMA for that kind of damage requires homeowners to get an insurer’s written denial of regular homeowner coverage for FEMA help.

By the nature of what Citizens does — the state’s insurer of last resort — a higher rate of closing claims without payment would be expected, Adams contended.

“We are the ones that are writing the coastal homes,” he said. “We’re the ones that are writing the wind-only coverage.”

2024’s first two storms have similar hurricane claims results

Raw data on catastrophe claims on the Office of Insurance Regulation’s website show insurers collectively closed 28% of Hurricane Ian’s claims in 2022 without a payment, a figure that’s markedly less than the early results from this year’s first two hurricanes.

More than half of Hurricane Debby’s claims so far were closed without payment and 45% of Helene’s claims fell into the same category.

Homeowners have a year after the date of landfall to file a claim for storm damage with their insurance company.

Democratic Rep. Hillary Cassel of Hollywood, expects that it will become more apparent after this year’s storms that the tort reform that passed in 2023 will make all the insurance companies less accountable and less inclined to make their policyholders whole after a storm hits.

“Since now there is zero incentive for insurance companies to do right by consumers,” Cassel said.

Citizens’ insurance officials: Not much to see here

Citizens policyholders have filed claims in response to the latest slew of storms and Adams told them that the same factors at work in 2023 may again propel the percentage of claims closed without payment from this year’s storms at a level greater than private insurers’.

“It makes sense, from a Citizens’ perspective, that we will probably have more closed-without-payment claims than many of the other carriers,” Adams said.

For Hurricane Debby, which made landfall Aug. 5 in the Big Bend area at Category 1 storm strength, Citizens has received 3,033 claims and have closed 87% of those, Adams said. Since Hurricane Helene, which hit not far from Debby’s landfall in the Big Bend on Sept. 26 as a Category 4, Citizens’ policyholders have filed 14,253 claims with 90% closed, Adams said. Milton, which came ashore in Sarasota County on Oct. 9 has triggered 54,554 claims to date with about 76% closed, Adams reported.

He did not say what percentage were closed without payment, but he doesn’t expect that these storms will mean great payout levels since it appears Citizens’ policyholders did not sustain that much damage this hurricane season. Helene and Debby’s damage is mostly the result of storm surge, which Citizens’ policies don’t cover, nor do the majority of homeowner insurance policies, he said. And, although the National Weather Service reported Hurricane Milton coming ashore as a Category 3 storm, Adams saw it differently.

“I believe that this storm fell apart before it made landfall,” Adams said. “I went out and did damage assessments across all the landfall areas and across the entire state. We found very few homes that had any type of wind damage and didn’t see significant damage that would be structural unless a tree or something like that fell.”

He acknowledged that there were 137 tornado warnings during Milton, however.

“There are pockets across the state that did get some pretty significant wind damage, but again, not to the point that it’s knocking homes off foundations, ripping the structure apart,” he said. “We didn’t see any of that as we did our inspections.”

Anne Geggis is the insurance reporter at The Palm Beach Post, part of the USA TODAY Florida Network. You can reach her at ageggis@gannett.com.Help support our journalism. Subscribe today