Published: November 11, 2024, 5:20 PM

Updated: November 11, 2024, 6:26 PM

JACKSONVILLE, Fla. – Contractor fraud is a widespread issue in Florida, from pools to custom home builds and roofing fraud.

It can be a disappointing and costly mistake for homeowners.

Christopher Cobb has decades of experience handling contractor fraud cases. In 2012, he was appointed by then-governor Rick Scott to serve on the State of Florida’s Construction Industry Licensing Board.

“It’s a billion-dollar problem,” Cobb said.

News4JAX asked him what, if anything, consumers can do to protect themselves. In many cases, the answer is nothing.

“It happens all the time, and unfortunately, it’s financially related,” Cobb said. “What you see is you see contractors getting in over their head with either the amount of work that they have, and they will take, draw money from one project and apply it to another and create shortfalls. And then they’re always, constantly trying to play catch up. And at some point, if something goes wrong in that chain, homeowners get damaged and hurt, and that’s when the complaints come in.”

Some common tactics used by fraudulent contractors include: Disappearing after payment, providing substandard work or materials, and involving homeowners in insurance fraud schemes.

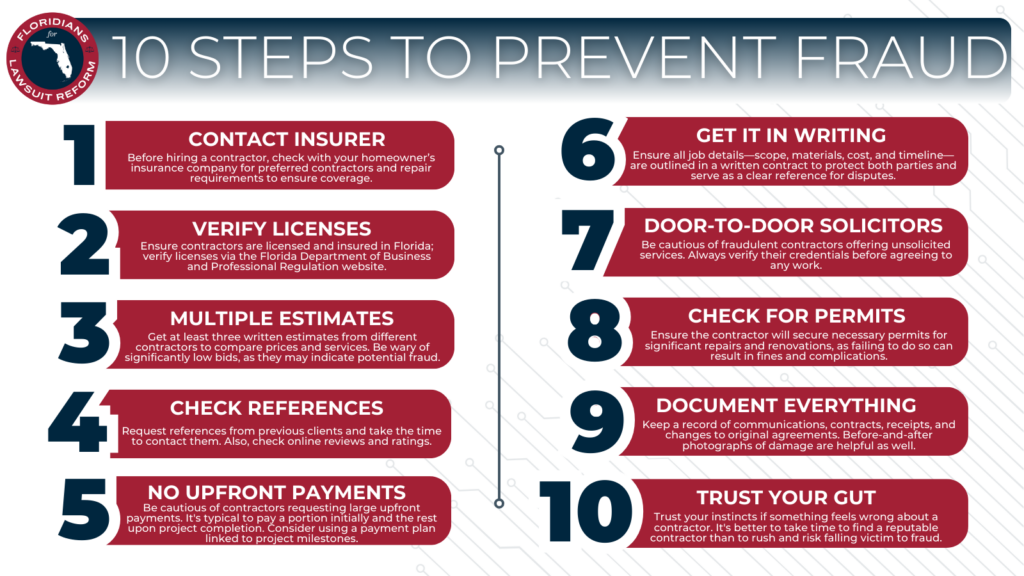

The best advice Cobb has is for homeowners to research their contractors before any papers are signed or payments are sent.

“The homeowner has a responsibility to vet the contractors to the extent they can. If I do all the vetting activities and I do them perfectly, that still does not necessarily say that I’m going to avoid having fraud, because if you’re dealing with a dishonest person, no matter how much you vet them, the dishonesty is to deceive,” he said.

That’s exactly what happened to homeowners in Nocatee earlier this year. A seemingly reputable home builder with a successful business record was accused of stealing $15 million from a group of 13 people.

Reality TV Star Captain Sandy Yawn was one of the homeowners duped by the Pineapple Corporation. In 2021, President Spencer Calvert told the Jacksonville Daily Record he was attracting more luxury home buyers than ever from out-of-state.

State Attorney R.J. Larizza said that’s a big part of the problem.

“St. Johns is such a booming environment. I mean, we have people moving here residentially. We have businesses moving in. I mean, they’re building a Bass Pro Shop. You’ve got a new Costco, you got a Buc-ees. So, people are flocking to St. Johns County. So, it creates what I call a target-rich environment, because the more construction you have, the more people moving in, the more possibilities or opportunities there are for scammers to come in and take advantage of folks, basically rip them off,” Larizza said.

Larizza’s advice for homeowners is pretty simple.

“Don’t give your money to folks before you vetted them. The best way to get your money back is to keep it and to be very cautious about who you entrust it to,” he said.

In the event you are scammed, report the incident to law enforcement and reach out to your local St. Attorney’s Office. But don’t expect to get your money back.

“It’s difficult to get that money back. They take it, it’s gone, and then sure, we can do jail time. We can do prison time, we can do probation and have a large amount of restitution for them to pay back. But the system says that if a person doesn’t have the ability to pay back the restitution, and in some cases, it can be millions of dollars if they don’t have the ability, you can’t lock them back up for a violation of probation, which is very frustrating to everybody,” Larizza said.

Attorneys like Cobb can help in some cases, but the reality is that oftentimes it costs more money to pursue litigation. In many cases, homeowners have to cut their losses.

“You want to help them, but sometimes the system doesn’t let you. And I put myself in their shoes a lot thinking I could not imagine if I was scammed out of $100,000 from a contractor who said he was going to do something,” Cobb said.

Homeowners do have some rights under state law.

The Florida Homeowners’ Construction Recovery Fund is a fund of last resort.

If you’ve exhausted all other options for repayment and have a judgment against a contractor, you could be eligible to tap into the $24 million state fund. But the maximum amount you can be reimbursed is $25,000.

“There’s room for change in that,” Cobb said. “There needs to be a more concerted effort to pursue these bad actors. Most of the time, people will do what you need them to do if they’re threatened with jail time, you know, if it’s just money, well, they can chase me until I’m either tired of running, or I can just pay them back, or they just stop chasing me.”

Larizza agrees.

“It’s possible that there is a way to find a funding source for to beef up, maybe the AGs fund, or maybe to create another fund, maybe, you know, there are ways that, within the licensing that could be done, I don’t know, but I’m a big advocate for just don’t lose your money to begin with,” Larizza said. “Be diligent, be smart and ask questions.”

As fraud claims become more common, Larizza has a message for the bad guys.

“The folks out there that are ripping people off, you know, be careful, because we’re going to come for you,” he said. “If we can prove it, we’re going to prosecute you, and it will not be a pleasant experience.”

So here are the big takeaways:

Before signing a contract, homeowners should, talk to people who have previously worked with the contractor, go beyond who the builder suggests you talk to, look for any claims on the person’s license with the DBPR at myFloridalicense.com, ask your contractor to sign a “Release of Lien” to avoid issues with unpaid subcontractors and consider having an attorney review any documents you sign.