Keith Kravitz –

July 11, 2024

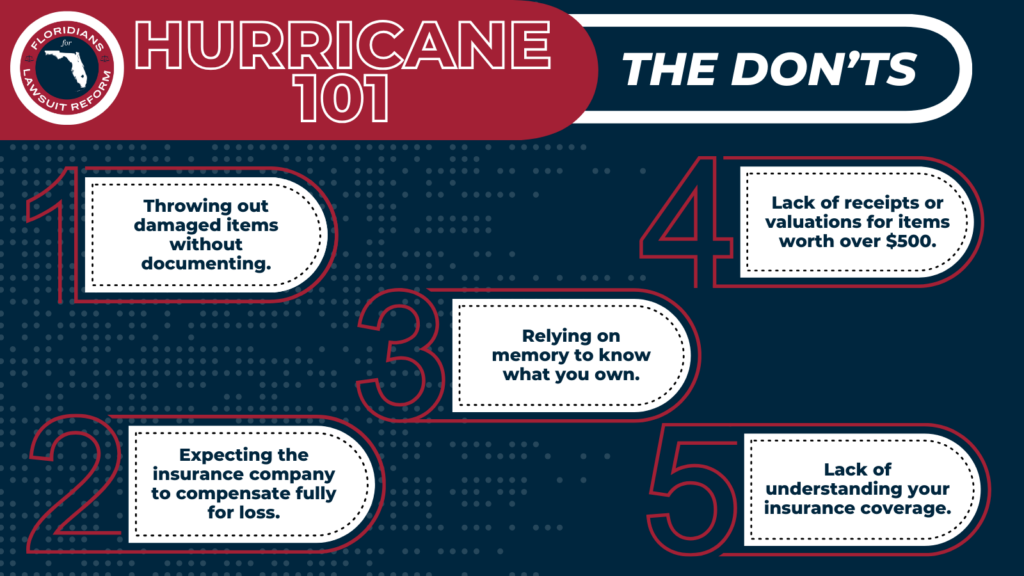

As hurricane season approaches, homeowners in vulnerable areas need to prepare thoroughly to protect their property and ensure they can recover swiftly in the aftermath. One of the critical aspects of hurricane preparation is understanding the common pitfalls that homeowners encounter when filing insurance claims. Here are five mistakes to avoid to ensure you receive the compensation you deserve after a hurricane.

- Throwing Out Damaged Items Without Documenting Them

In the chaos following a hurricane, it’s understandable that homeowners want to clean up and restore order as quickly as possible. However, one of the biggest mistakes you can make is throwing out damaged items without documenting them first. Insurance companies require evidence of the damage to process your claim. Before discarding anything, take detailed photographs and videos of all damaged items and areas of your home. This documentation will be crucial in proving your losses and ensuring you receive adequate compensation.

- Expecting the Insurance Company to Compensate Fully for Their Loss

Many homeowners assume that their insurance will cover all their losses after a hurricane. Unfortunately, this is often not the case. Insurance policies typically have limits and exclusions that can significantly affect the amount you receive. It’s essential to understand the specifics of your policy, including deductibles, coverage limits, and any excluded items. Being aware of these details before a disaster strikes can help you manage your expectations and prepare financially for any gaps in coverage.

- Relying on Memory to Know What They Own

After a hurricane, the task of recalling every item you owned can be daunting, especially when stress and emotions run high. Relying on your memory to list all your possessions is a recipe for missed items and inadequate claims. Creating a detailed home inventory before a hurricane hits is crucial. This inventory should include photographs, descriptions, and values of all your belongings. Services like My Property Vault offer comprehensive home inventory solutions that can help you document everything thoroughly, providing a reliable record in case you need to file a claim.

- Lack of Receipts or Valuations for Items Worth Over $500

For items valued over $500, lacking receipts or proper valuations can lead to disputes with your insurance company and reduced compensation. High-value items like electronics, jewelry, and artwork should be appraised regularly, and receipts should be stored securely. If you don’t have proof of ownership and value, insurers may not cover the full replacement cost. Ensuring you have up-to-date valuations and keeping receipts can smooth the claims process and help you recover the full value of your lost or damaged items.

- Not Knowing What They Are Covered For or Not Covered For in Their Insurance Policy

One of the most critical mistakes homeowners make is not thoroughly understanding their insurance policy. Every policy has specific terms, conditions, and exclusions that dictate what is covered and what is not. Before hurricane season, review your policy carefully. Pay attention to coverage limits, deductibles, and any exclusions related to natural disasters. Knowing exactly what your policy entails can prevent unpleasant surprises and allow you to take additional measures, such as purchasing additional coverage if necessary, to protect your assets fully.

Conclusion

Proper preparation and awareness are key to navigating the insurance claims process effectively after a hurricane. Avoiding these common mistakes can make a significant difference in the compensation you receive and your overall recovery experience. By documenting your property thoroughly, understanding your insurance policy, and maintaining proper records, you can ensure that you are well-prepared to handle the aftermath of a hurricane and protect your financial well-being. For professional assistance in creating a comprehensive home inventory, consider services like My Property Vault to help safeguard your assets and streamline the claims process.

For more information or to schedule a service, visit www.mypropertyvault.com or call 888-VAULT-00 (888-828-5800).

Prepare now to protect your future.