Floods are a truly ruinous type of natural disaster.

Homeowners might flee at the height of a hurricane or other storm and return to find their home in disarray, the water destroying many of their possessions and damaging their homes.

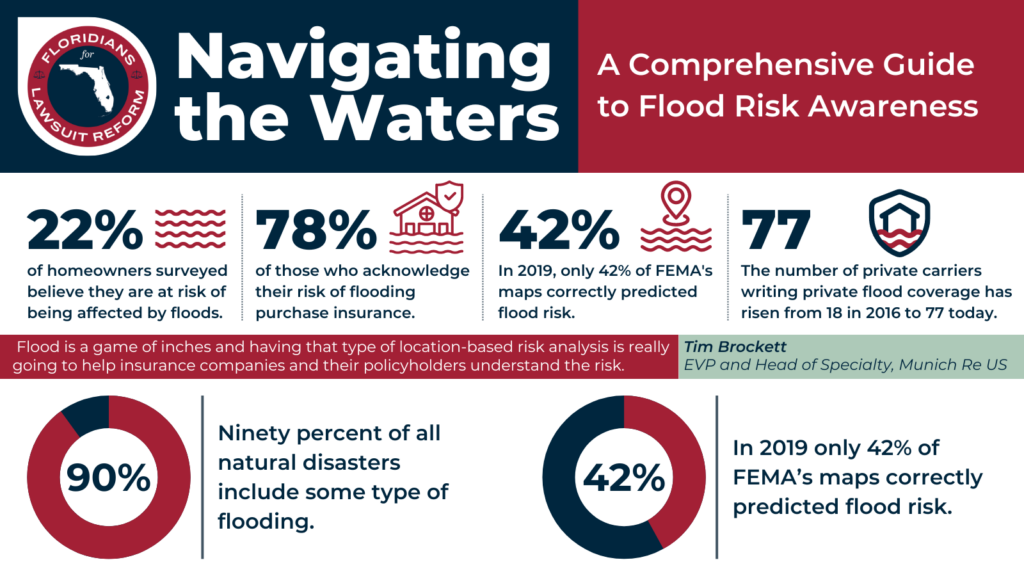

Yet despite the devastation floods can cause, only 22% of homeowners surveyed by Munich Re and the Insurance Information Institute (Triple-I) believe they are at-risk of being impacted by flooding. Only 78% who believed they were at risk purchased insurance.

“Ninety percent of all natural disasters include some type of flooding,” Tim Brockett, EVP and head of specialty for Munich Re US “It is an underestimation of risk.”

A mix of inaccurate flood maps (in 2019 only 42% of FEMA’s maps correctly predicted flood risk) and wishful thinking might be to blame for why property owners are so terrible at estimating their vulnerability to flooding. If a mortgage lender doesn’t require flood insurance, it’s easier and cheaper to go without.

As more and more homes face flooding insurers will play a critical role in educating property owners about the risks of damage and their insurance options. Some may create products suited to this increase in exposures and invest in technologies that help accurately model risk and prevent damages.

Why aren’t property owners purchasing flood insurance?

There are two main reasons homeowners may not be purchasing flood insurance policies: cost, and the administrative burden of buying coverage separate from a homeowners policy.

Let’s start with the cost. As Brockett notes, “flood insurance isn’t cheap.” For years, homeowners accessed affordable policies through the National Flood Insurance Program (NFIP). The FEMA managed program launched in 1968, was in response to the growing unavailability of flood insurance in the private market.

Homeowners with federally backed mortgages in Special Flood Hazard Areas and those who received any form of federal disaster assistance and want to be considered for future funds are required to purchase flood insurance per the Flood Disaster Protection Act of 1973. The NFIP helps make it available.

Many homeowners aren’t mandated to buy the policies, however. They might think they’re at less of a risk because the government doesn’t mandate that they purchase flood insurance or they might be concerned about the costs — especially as rates for regular homeowners insurance policies continue to rise due to inflationary pressures. A lack of location-based pricing and reliance on broad based flood maps can compound the issue.

“It’s still a discretionary purchase unless you’re in a special flood hazard area and your mortgage requires you to have it,” Brockett said.

Others may want flood insurance, but don’t know how to acquire it. Flood insurance is generally separate from a homeowner’s policy, but some insureds may think they’re one-in-the-same.

“There’s an administrative burden associated with buying a separate flood policy and also having a homeowner’s policy,” Brockett said. “You’re going to have to go through all that to have comprehensive coverage.”

Navigating the flood insurance market

There have been a number of advances in private flood insurance policies in recent years, but the “NFIP is still the dominant provider of flood insurance in the U.S.,” according to Brockett. The NFIP collects $4.6 billion in annual written premiums for approximately five million policies.

However, Brockett said, “the private market has been growing year-over-year.” In 2022, net written premiums for private flood insurance reached $1.13 billion. Compared to 2016, when there were only 18 insurers writing private flood coverage, there are now 77 private carriers and they underwrite 32.1% of total flood coverage.

Part of the reason for this growth: NFIP’s Risk Rating 2.0 program, meant to more accurately model and price risk, has caused rates to increase for many homeowners. “There were some policyholders that saw some reductions, but by and large, pricing is going up,” Brockett said.

Private insurers are seeing opportunity in the flood market, especially now that modeling has improved that help them accurately predict and price risk. Private companies are also able to be more nimble when it comes to adopting new coverages that respond appropriately to typical damages resulting from flooding.

Private insurers continue to face some challenges, however. NFIP’s Risk Rating 2.0 still caps how much policy rates can increase year-to-year. It will still be a few years before those policies reach adequate rates and the private market won’t be able to fully compete until then. Also, if a homeowner leaves the NFIP for a private policy, they can’t return to the NFIP at the discounted rate, which keeps many policyholders with the program.

“There’s obviously a lack of incentive for certain policyholders to leave the NFIP,” Brockett said.

Innovative flood insurance solutions

Home and business owners with flood risk should prioritize finding an insurer who can meet their needs at a reasonable rate. Munich Re US has developed a white-label, turnkey flood endorsement that can be added on to a homeowner’s insurance policy, reducing the administrative burden and providing coverage to its policyholders at a reasonable cost.

The product is designed with the fact that floods don’t often cause total losses in mind. People often need coverage for damages; not total rebuilds. The policy covers personal property, dwellings and other structures, debris removal, property moved to safety and loss of use, with limits between $5,000 up to $50,000. And the lower limits help keep the premiums reasonable.

“Most of the time, in a typical flooding event, you’re not being washed off the slab,” Brockett said. “It’s a lot of clean-up costs.”

Additionally, Munich Re US’ Floodscape™ tool allows insurers to understand where they may have flood risk in their portfolios. It models over 40,000 scenarios in the 48 continental states, allowing carriers to understand their risk and how it changes over time. Tools like this can enable carriers to invest in the private flood insurance space.

“We can pinpoint flood hazards down to really granular resolution,” Brockett said. “You plot your exposures on a map. You’re actually aggregating by river system, and coming up with realistic disaster scenarios.”

Munich Re US is also investing in developing new ideas and preventative tools to help homeowners reduce their risk. Brockett believes that linking policy costs to risk mitigation measures, whether at the community or location level, will help insureds understand the importance of protecting their properties from losses — not just purchasing insurance to pay for them after the fact.

“The policyholders would have less premium to pay and we’d stop the losses from happening in the first place,” Brockett said. Doesn’t that sound like a win-win?

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Munich Re US. The editorial staff of Risk & Insurance had no role in its preparation.