- Familiarizing yourself with a few key things in your home and flood insurance policies will help you understand what costs you are responsible for covering should your home be damaged.

- Don’t wait until your belongings are gone to find out how valuable they are.

- Scanning and uploading your insurance policies and other important documents to a cloud storage service allows you to access them as long as you have cell service or access to Wi-Fi.

The Atlantic hurricane season runs from June 1 through Nov. 30 with the peak of the season on Sept. 10. The most activity happens between mid-August and mid-October, according to the National Hurricane Center.

An overheated Atlantic Ocean and a rising La Niña have forecasters predicting a highly active hurricane season, one that could rival one of the busiest years on record.

The key to getting through storm season is being prepared. That’s why The Palm Beach Post has compiled tips, lists, contact numbers, graphics and maps that should help you prepare for a storm, and, if need be, get through it fine.

Aside from the obvious ways to physically prepare your home for any expected damage — boarding up windows, using sandbags, securing patio furniture, etc. — there is an often-overlooked hurricane prep step that could save you money.

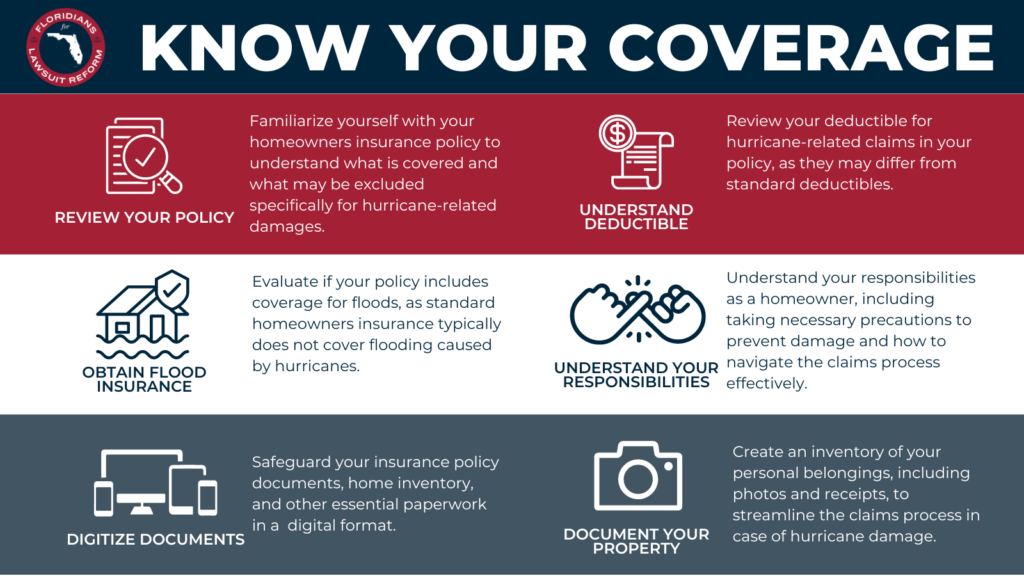

Familiarizing yourself with a few key things in your home and flood insurance policies will help you understand what costs you are responsible for covering should your home be damaged. And documenting the condition of your home and most valuable possessions could make the process of filing a claim after the storm much easier.

What should I pay attention to on my home insurance policy?

If disaster hits, you don’t want to be left in the dark about any gaps in your policy coverage. For example, if you’re a new homeowner, you might not know that flood and home insurance are typically sold separately. Most home insurance policies don’t cover damages sustained from flooding.

To familiarize yourself with what your policy or policies do and don’t cover and if there are costs you might be responsible for covering after the storm, re-read the “Exclusions” and “Duties After Loss” sections of your home or flood insurance policies.

Homeowners’ insurance policies usually cover damage from strong winds, including strong winds from hurricanes. But your policy might have a separate deductible for hurricane damage.

How to prepare for a hurricane and get the most out of your homeowners insurance claim

Don’t wait until your belongings are gone to find out how valuable they are. If your insurance company has to assess any post-storm damage to your home or property, they will probably ask if you have any proof or documentation of its condition before the storm.

Whether or not you can give that to your insurer likely will determine how much compensation you get back for damages.

Before the storm hits or before you evacuate, use your phone camera to take a long, slow video of your home and property to document what it looks like when everything is in its place. Take photos of your home and property as well.

If you want to be thorough, make a detailed list of your valuable belongings and include receipts for more expensive items like appliances, furniture and electronics. At the very least, you may want to take pictures of these items to be able to prove that they were not damaged before the storm.

What should I do with my important documents before a hurricane?

Don’t rely on paper copies of your most important documents, including your home or flood insurance policy documents.

Most Floridians know to keep their insurance policies, family medical information, deeds, wills and other important paperwork in a fire-proof, water-proof box or safe deposit box. But getting to those physical copies can be challenging if you’re in an emergent situation.

Scanning and uploading your insurance policies and other important documents to a cloud storage service like Google Drive, iCloud or Dropbox allows you to access them as long as you have cell service or access to Wi-Fi.