In 2023, Florida’s domestic insurers turned a net profit for the first time in seven years, a new report by marketing intelligence company S&P Global said.

The study of “around 50” Florida-based insurers credited the turnaround to investment income, a mild hurricane year, and tort reforms that took effect in March 2023.

The group reported $147.3 million in net income for 2023, according to the analysis by Jason Woleben of S&P Global Market Intelligence that was released on Wednesday. That compares to net losses of more than $1 billion in each of the previous two years.

The results are likely to renew hopes that insurers might soon begin to reduce property insurer rates for Florida’s homeowners.

The report quoted Universal Insurance Holdings CEO Stephen Donaghy as telling investors during the company’s third-quarter earnings report last year that future rate reductions in Florida might be possible.

Yet Universal Property & Casualty, the flagship company of Universal Insurance Holdings, was among just four of Florida’s top 22 private-market insurers, as ranked by direct premiums written, to post a net loss in 2023.

The company lost $99.6 million last year, compared to $141.2 million in 2022, the report said.

State-owned Citizens Property Insurance Corp. posted a $746.5 million net profit last year after reporting a $2.24 billion net loss the year before, Woleben wrote.

Citizens’ results were not counted among the totals in the report.

Other companies that made money last year were State Farm Florida ($52.2 million), First Protective ($16.2 million), Slide ($15.5 million), American Integrity ($16.6 million), American Coastal ($105.9 million), ASI Preferred ($13.5 million), Edison ($42.0 million), Security First ($13.6 million), Heritage Property & Casualty ($20.2 million), Homeowner’s Choice ($12.9 million), Florida Peninsula ($46.8 million) and Auto Club Insurance Co. of Florida ($40.9 million).

Companies that posted losses included Tower Hill Insurance Exchange (-$86.9 million), Kin Interinsurance Network (-$59.5 million), and Privilege Underwriters Reciprocal Exchange (-$29.7 million).

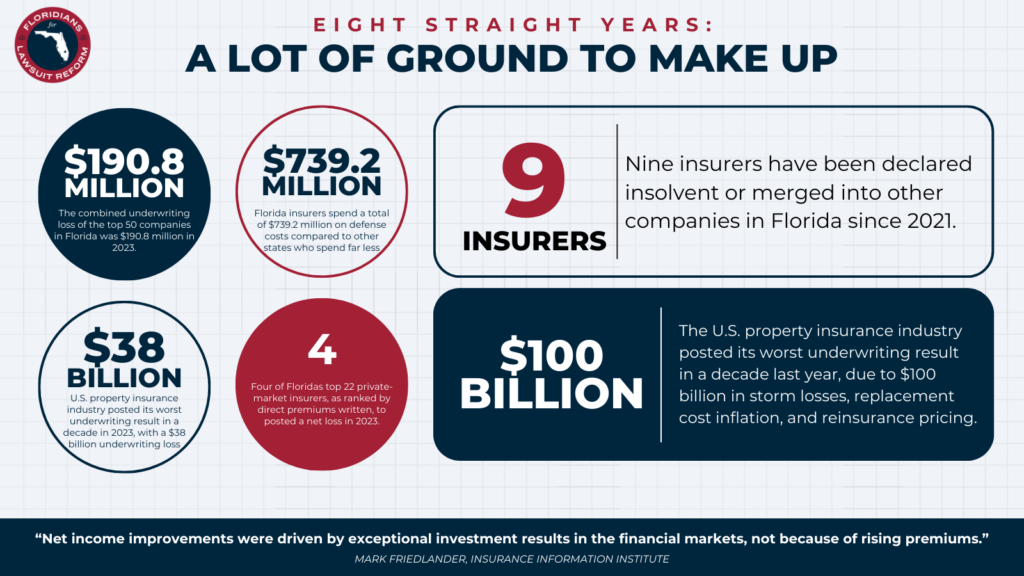

While the top 50 companies also posted an underwriting loss for the eighth straight year, the combined loss of $190.8 million was “considerably better” than losses of nearly $1.8 billion in 2022 and $1.52 billion in 2021, the report said.

The 2021 and 2022 loss totals included nine residential insurers that have since become insolvent or merged into other companies.

Rate reductions soon?

The improved income result fuels confidence “that you will either see rate reductions or stability of rates over the next six to 24 months,” said Stacey Giulianti, chief legal officer for Boca Raton-based Florida Peninsula. “My understanding is that the industry is beginning to see the positive effects of legislative action, and loss ratios (insurers’ expenses compared to revenue) are in sharp decline.”

Mark Friedlander, spokesman for the industry-funded Insurance Information Institute, was less optimistic, stating that the U.S. property insurance industry posted its worst underwriting result in a decade last year, with a $38 billion underwriting loss due to $100 billion in storm losses, replacement cost inflation, and reinsurance pricing.

“Net income improvements were driven by exceptional investment results in the financial markets, not because of rising premiums,” Friedlander wrote.

While forecasts for the upcoming hurricane season have not yet been released, Friedlander said “early indications are this is going to be a very active year with the potential of significant impacts on Florida.”

Some scientists have forecast a La Niña by summer. That’s a pattern of cooler waters along the equator in the Pacific Ocean that often leads to more active hurricane seasons in the Atlantic Ocean.

Projections of an active storm season would increase costs that Florida insurers would have to pay for reinsurance, and those increases would be recovered by raising prices for homeowners coverage in the state, Friedlander said.

Reduced litigation levels in Florida will hopefully keep rate increases “moderate” in Florida compared to recent years, he said. “However, declining rates are not a realistic scenario in 2024 based on the macro factors impacting the industry.”

Defense costs still high in Florida

S&P Global’s report states that property insurers in Florida are optimistic about the long-term benefits of tort reforms that were enacted in 2022 and 2023.

Effects of tort reforms could be seen in the firm’s tallies of Defense and Cost Containment Expenses — costs related to investigating or litigating specific claims.

DCCE costs can include legal fees, court costs, expert witnesses, investigation costs, costs of records duplications, expert witnesses, and trial preparations.

In Florida, DCCE costs among property insurers fell to $739.2 million after hitting $1.6 billion in 2022, thanks largely to Hurricane Ian. It’s the lowest total since 2019, a year no hurricane struck Florida, Woleben wrote.

A majority of the incurred defense costs came from the homeowners business line. They fell to $593.5 million in 2023, compared with $1.23 billion in 2022 and $571.1 million in 2021.

Even at $739.2 million, Florida insurers spend much more on defense costs than any other state in the nation, S&P Global said. States with the next highest defense spending totals were California ($401.6 million) and Texas ($284.7 million).

While plaintiffs’ attorneys would say the high number is caused by insurers failing to pay or underpaying, Giulianti blamed the “one-way attorneys fee statute” that encouraged plaintiffs lawyers to file suit over what he called relatively small fee disputes.

A state law in effect for more than a century required insurers to pay plaintiffs’ legal fees if litigation resulted in a judgment or settlement that exceeded an insurer’s original offer by any amount. But the tort reforms narrowed the types of cases that require insurers to pay plaintiffs’ legal fees, making attorneys less likely to file them, Giulianti said.

“With an attorney fee provision, you take any case at all, because all you have to do is get a settlement, and 99.9% of the cases settle, and you tack exorbitant fees onto it,” he said. “Now, if a lawyer is going to take a case, they have to believe in it strongly. It has to be extremely meritorious and serious.”

Giulianti added that claims have declined as well, because many were previously “either trumped up or manufactured by public adjusters and trial lawyers.”