Published July 14, 2023 at 11:01 AM EDT

The Florida insurance industry is in a state of crisis.

Over the past year and a half, 15 Florida insurers placed moratoriums on writing new business in most counties and seven were declared insolvent.

Then, earlier this week, Farmers Insurance notified policy holders that the company is pulling out of Florida altogether.

It appears the financial relief promised when state legislators passed significant insurance tort reform at the end of 2022, isn’t expected anytime soon.

Even though the average homeowner experienced a 42 percent rise in insurance premiums last year, industry expert Mark Friedlander of the Insurance Information Institute predicts rates will go up again.

“Significant increase are being incurred by homeowners in counties across the state, not just coastal counties,” Friedlander said. “This insurance crisis filters down to all levels of homes, all income levels and all different types of communities well away from the coast or coastal municipalities, it doesn’t matter.

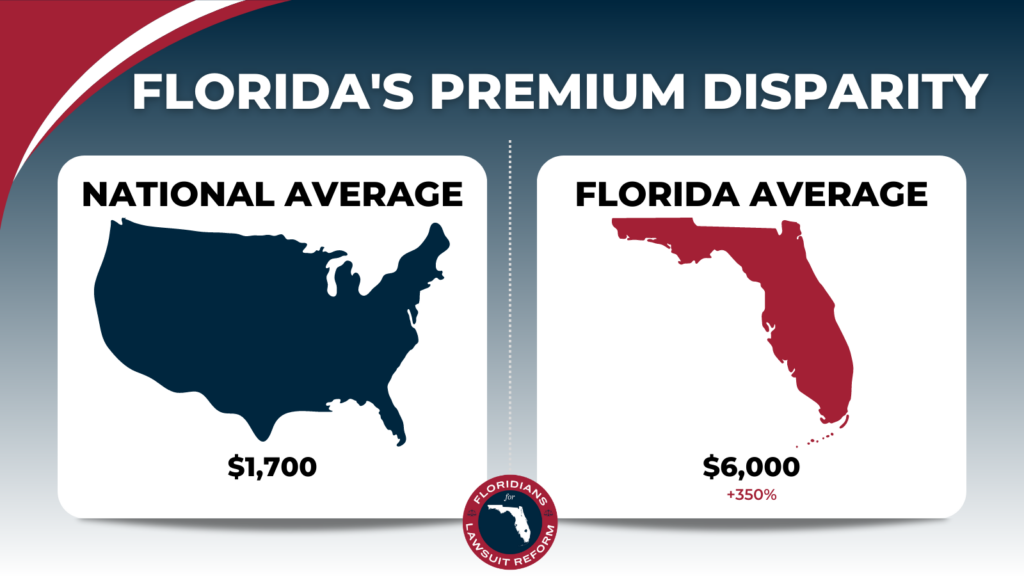

Across the country, the average home policy costs $1,700.

Not in Florida.

“Floridians pay the highest average premium in the U.S. at $6,000 a year with a 100 percent cumulative increase just over the last three years,” Friedlander said.

That’s insurance to cover expenses caused from hurricane wind, as well as other catastrophes like fire. This does not include flooding, which requires an additional policy.

There are many reasons for price increases in insurance.

Fraud, which the legislature tackled during a special session at the end of last year, is the biggest contributor said Friedlander.

There’s also climate change which is producing stronger storms and more frequent weather events.

And there’s inflation. Simply put, it cost more to repair and replace items.

Friedlander says the Florida’s insurance crisis is also effecting would-be Florida homeowners: “The leaders of the National Association of Realtors tell us that they are seeing conditions in Florida where they are having problems on closing on some homes because they cannot find insurance. It’s happened. …I wouldn’t consider it a red alert at this point but it’s certainly something to watch. And unfortunately, it will have negative impacts on our very robust real estate market.”

Friedlander applauds moves by the Florida Legislature that stopped one-way attorney fees which largely abused the legal system. The reform measure killed what is called “assignment of benefits”.

Assignment of benefits fraud involves dishonest contractors who typically go door-to-door telling homeowners there’s been a recent storm with damage in the community and they’d be happy to go up on your roof and check for damages. And if they do find damages, they’ll go ahead and handle the claim with the insurance company.

“What happens is these unscrupulous contractors take control of your claim. They then replace the roof, that in most cases, is not a legitimate loss -– meaning it should not have been covered by insurance. When they send a bill to the insurance company, they typically mark up the bill 50 to 100% over a legitimate roof replacement. So, say a legitimate replacement is $20,000, an unscrupulous contractor will send a bill to your insurer for $40,000. Obviously, the insurer is not going to pay that bill so they reject it and then the litigation ensues. So, a lot of the legal system abuse we’ve seen is generated by this assignment of benefits issue.”

As result, all Floridians are paying for the cost of fraud litigation. Fraud has can be difficult to combat in a state known to attract fraudsters.

“Unscrupulous contractors continue to initiate the schemes with workarounds,” said Friedlander. “So unfortunately, we are still seeing roofing scams in neighborhoods across the state.

And there’s potentially more bad news on combatting fraud: Friedlander said in the days leading up the Florida’s insurance reform laws taking effect, more than 280,000 lawsuits were filed against Florida insurers.

“They did that because they wanted to get those suits on the books before this one-way attorney fees were banned. That was the full reason for the mass filing of lawsuits,” Friedlander said.

In spite of these insurance reforms and the latest massive rate hike, Friedlander expects prices to jump another 43 percent in the coming year.

“We’re very supportive of those reforms and thing they will bring stability to Florida’s market which has been extremely volatile over the past few years. But to promise any consumer that their rate is going to decline is not realistic because no rates in the U.S. are declining with the rising cost of catastrophes, rising replacement costs.”